2023 Launch Lessons

Access has become increasingly important to commercial success and is the leading performance indicator for a brand's launch. While each brand faces its own unique access landscape and challenges, two key trends have emerged as ones to watch in 2024.

Untangle Complexity

03/18/2024

Read time: 5 min

Introduction

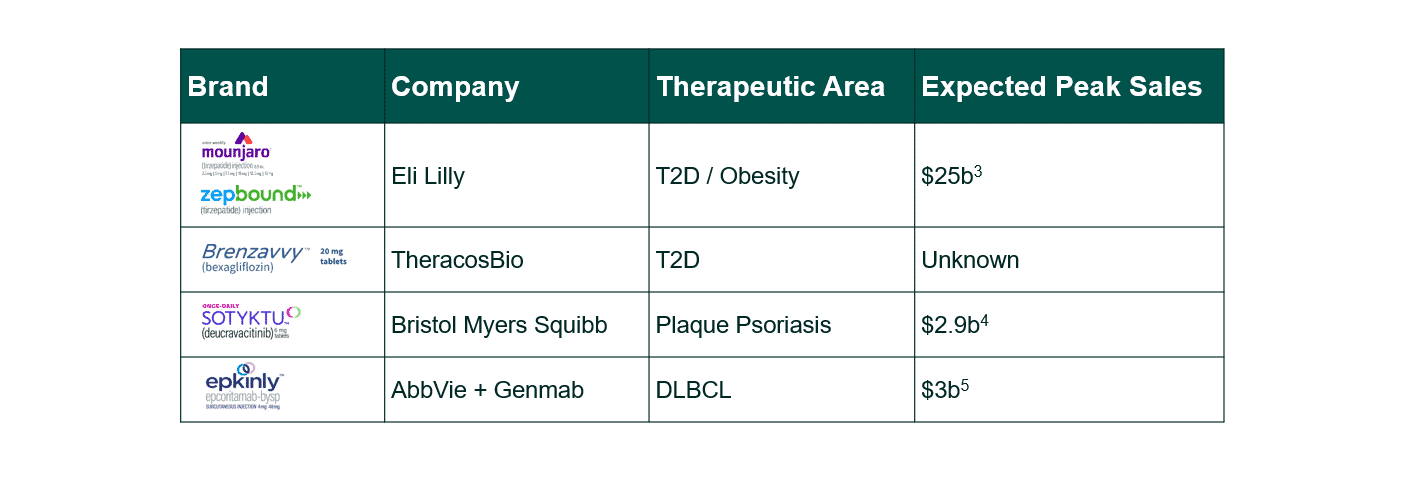

Between 2022-2023, the FDA approved 92 novel drugs, spanning a broad array of therapeutic areas including: oncology, Alzheimer’s disease, Type II Diabetes (T2D), obesity, Duchenne Muscular Dystrophy (DMD), and post-partum depression (PPD).1 However, even as clinical innovation advances, pharmaceutical companies are challenged to execute successful launches.2 We have observed teams inaccurately assess a brand’s market access profile, under-allocate commercial resources, and mis-calibrate how to effectively differentiate their product.

It is more critical than ever for manufacturers to understand how to leverage their brand’s unique value proposition and their organization’s commercial infrastructure to clear market access hurdles. This paper seeks to evaluate a few of the most anticipated launches from 2023, along with how their market access environment impacted their performance. We will unpack the strategies and tactics that drug manufacturers implemented to minimize launch friction to effectively compete.

Case Study 1: Mounjaro (tirzepatide), Zepbound (tirzepatide) and Brenzavvy (bexagliflozin)

Access Hurdles: Mounjaro, Zepbound, and Brenzavvy launched as challenger brands against incumbents in highly scrutinized markets (T2D and obesity). To combat rising healthcare costs in these classes, insurers have increasingly passed-through coverage decisions onto employers. This decentralization of diabetic & obesity coverage has eroded patient access, as employers seek to restrict even T2D brands to limit off-label use.6,7

Strategies Employed: Despite challenging market dynamics, Eli Lilly has outpaced launch expectations through patient-focused tactics, including:

- Expanded telehealth networks

- Direct-to-patient pharmacies

- Generous patient support programs8

- Attractive cash price option

TheracosBio has circumvented insurance negotiations by partnering with Mark Cuban’s online distributor, Cost Plug, to provide product directly to consumers.9

Case Study 2: Sotyktu (deucravacitinib)

Access Hurdles: Sotyktu launched into the plaque psoriasis market, squaring off against entrenched competitors: Otezla, Humira, and Skyrizi and anticompetitive rebate “walls” that can stunt launch brand uptake.

Strategies Employed: In the face of staunch market competition, Sotyktu has gained upwards of 12% market share via a variety of patient centered market access approaches, such as:10

- Extensive 3-year bridge program

- Direct-to-consumer marketing

- Patient support programs

Case Study 3: Epkinly (epcoritamab-bysp)

Access Hurdles: Epkinly launched as the first 3rd line subcutaneous bispecific antibody in the Diffuse Large B-Cell Lymphoma (3L DLBCL) market, and then was swiftly followed by direct competitor Columvi. Although there is some evidence that Columvi could be a more cost-effective therapy, Epkinly outperformed Columvi in its year-to-date US net sales by approximately $4 million. 11,12,13

Strategies Employed: There are several factors that have enabled Epkinly to pull ahead of Columvi, including:

- Pursued an accelerated approval pathway to be the first-to-market product14

- Established a superior clinical profile, outperforming Columvi in its phase 2 trials15

- Five percent greater response rate, with a median response time almost 3 months earlier than Columvi’s

- A cytokine release syndrome (CRS) occurrence rate almost 20% lower than Columvi’s

Market Outlook & Trends

Across these case studies, we observe a number of key market access challenges, along with two key trends in access for 2024:

- Decentralization of Access: There has been consistent proliferation of parties that define and shape healthcare coverage, requiring a continued consideration of access strategy beyond the payer. Manufacturers are increasingly asked to navigate conversations related to the total cost of care to large health systems (accounting for hospitalizations, comorbidities, etc.) In T2D and obesity, manufacturers must navigate the rising influence of employer groups on healthcare. Effective commercial teams must be equipped to negotiate and manage a number of healthcare parties all with specific and diverging interests.

- Patient-Focused Strategies: Across the board, there is a growing prevalence of healthcare consumerization – specifically with direct-to-patient strategies. Generous patient support programs are now required to compete in most markets. And we’re even observing direct-to-consumer strategies that evade access hurdles all together by forgoing traditional insurance. Ultimately, as the definition of access expands and the number of players defining your brand’s access increases, patient strategies must be prioritized.

Sources

[1] Center for Drug Evaluation and Research. “Compilation of CDER New Molecular Entity (NME) Drug and New Biologic A.” U.S. Food and Drug Administration, FDA.

[2] A recent study from Deloitte found that nearly one-third of drug launches between 2012-2021 missed financial expectations.

[3] Kansteiner, Fraiser. “With Lilly’s Mounjaro Set for Stardom, an Alzheimer’s Win Would Be ‘Icing on the Cake’” FiercePharma, 23 Sept. 2023.

[4] “$2.9 billion in Sales Forecast for BMS’ Sotyktu by 2029.” The Pharma Letter, 11 May 2023.

[5] Liu, Angus. “AbbVie, Genmab’s Lymphoma Drug Epkinly Snags FDA Approval in Heated Blood Cancer Race.” FiercePharma, 19 May 2023.

[6] Obesity care provider, Found, published a study that revealed nearly 70% of its patient populations did not have healthcare coverage for GLP-1 drugs to treat diabetes or weight loss.

[7] ELI reported during their 2023 Q4 earnings call that Zepbound only had coverage among one-third of commercial lives.

[8] Notably, ELI has restructured their commercial program, increasing the target co-pay from $0 to $25 and implementing new restrictions that stipulate patients must attest their prescription is for T2D.

[9] TheracosBio. “TheracosBio Announces Commercial Availability of BrenzavvyTM (bexagliflozin) for the Treatment of Adults with Type 2 Diabetes.” TheracosBio News and Events, 2023.

[10] Becker, Zoey. “Bristol Myers Holds on to Blockbuster Sotyktu Hopes, Plays down Otezla Threat.” Fierce Pharma, 2 Feb. 2023.

[11] The National Comprehensive Cancer Network (NCCN) has indicated both Epkinly and Columvi for 3rd line treatment with no preference

[12] Zahra Mahmoudjafari, Danilo Di Maio, Jia Li, Katherine L. Rosettie, Anthony Masaquel; Glofitamab Results in Cost Savings Versus Epcoritamab in Diffuse Large B-Cell Lymphoma (DLBCL): A Total Cost of Care Analysis. Blood 2023; 142 (Supplement 1): 3703.

[13] Genentech & AbbVie Q4-2023 Earnings

[14] Liu, Angus. (2023). Game on, AbbVie. Roche’s Columvi nabs FDA nod as 2nd bispecific for large B-cell lymphoma.

[15] Pharmtales, Roche’s Columvi and AbbVie’s Epkinly: The Battle For Breakthroughs In Large B Cell Lymphoma Treatment, 2023