Doing More with Less

The Need for Tighter Integration of Market Access into Biopharmaceutical Strategy

Unlock Success

01/16/2024

Read time: 8 min

A Brief Analysis of Biopharmaceutical Sector Underperformance

Recent years have seen astounding scientific advances in the biopharmaceutical industry. From the continued development of personalized cancer medications to the rollout of mRNA COVID vaccines, gene therapies, and next-generation obesity treatments, the industry has continued to leverage advances in scientific and technological understanding to push the boundaries of drug discovery. Despite that progress, a glaring concern has emerged: the returns of biopharmaceutical equities have lagged behind those of the broader stock market by a significant amount.

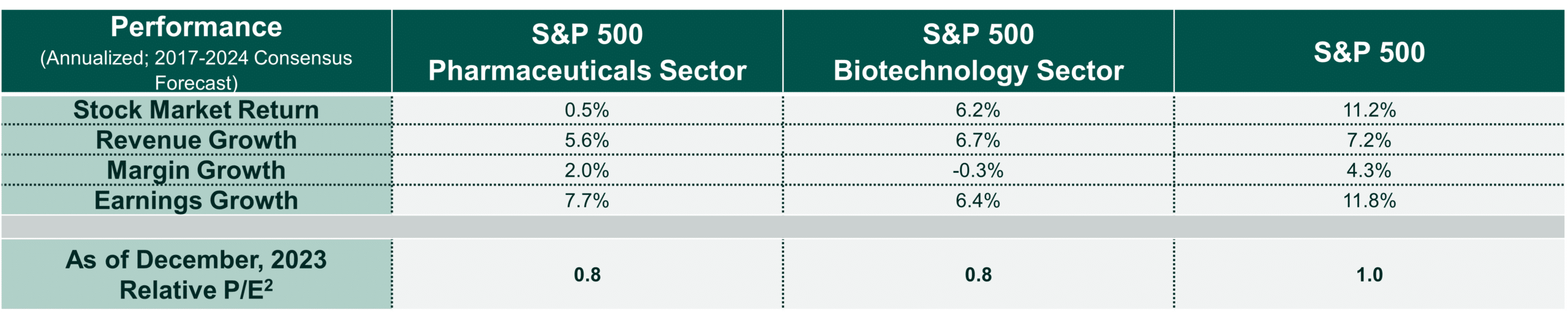

Figure 1: Overview of Pharmaceutical and Biotechnology Sector Performance vs. the Broader Market1

While the industry has done well to maintain positive earnings growth over a tumultuous period that included a global pandemic, it is underperforming in terms of both revenue and margin growth. This poses a major long-term challenge for an industry that relies on heavy, high-risk capital investment.

A natural reaction to underperformance over this period may be to point a finger at the Inflation Reduction Act or the emergence of a higher interest-rate environment. But forward-looking multiples in biopharmaceutical indices have improved since these variables were introduced in 2022, and now more closely resemble pre-pandemic levels. The market’s belief that the road ahead will be a bumpy one is, therefore, not new. But what is driving it, and why can’t the industry escape it?

One factor that is at the forefront of this trend is an increasingly constrained US market access environment. This environment has been shaped by three macro factors:

- Three PBMs / GPOs now control ~80% of the prescription drug market in the US, providing them with tremendous leverage to manage drug utilization and negotiate steeper discounts. This has led to declines in net drug prices for each of the past six years and the continued growth of formulary exclusion lists.

- Healthcare costs continue to make up a large share of GDP, putting pressure on payers to manage costs. Aging populations, growing debt burdens and a higher interest-rate environment will continue to place pressure on payers to rein in healthcare costs.

- Drug competition has broadly increased, providing payers with greater power to negotiate prices by threatening drugmakers with formulary exclusion.

Barring US anti-trust action on a scale not seen in this country for over a century, these trends aren’t going anywhere (a recent FTC probe into PBM and GPO behavior may end up having teeth, but it remains to be seen). This means that to re-establish its value to investors, the industry must demonstrate that it can outperform in an era in which market access will continue to be a major headwind. Underperformance relative to the market on both the top and bottom lines means that the industry must learn how to do more with less: accelerate top-line growth while improving operational efficiency. Saying this is one thing – doing so is another. How can organizations do more with less?

An Access-Driven Approach to Improving Performance

In our experience, biopharmaceutical manufacturers often view market access as a distinct silo within the broader commercial organization. Managing rebates, contracting for access, and providing patient services are viewed as critical functions but are frequently detached from organizations’ broader commercial strategies. Given the central role that market access plays in commercial success, doing more with less requires market access to be integrated into the organization’s DNA. Below we briefly describe three fundamental considerations for accomplishing this. While they may sound straightforward, we have seen many organizations struggle to implement them effectively:

A Disciplined Approach to Establishing a Target Patient Segment

In our experience, many of the brands we see failing to live up to their potential are those in which teams are unrealistic or imprecise in establishing a target patient segment. In these instances, organizations typically focus on targeting the largest addressable patient population based on the product’s label without an appreciation for the fact that payers will not allow them to play in such a broad segment without unsustainable discounts. This leads to wasted promotional dollars targeting patients (through either their HCPs or DTC) who will never be able to fill the product, damaging the brand’s equity in the eyes of its customers.

Incorporating the payer as a key stakeholder when establishing the target patient segment is critical to succeeding in today’s environment. While many organizations will conduct the due diligence of understanding how payers view a product prior to launch, they often do not have the stomach to adjust their strategy based on what they learn if it differs from a pre-existing approach. Staying disciplined in developing a target patient segment based on what is achievable from an access perspective is a core component of doing more with less.

In the short-term, this approach helps organizations to right-size their promotional efforts, optimizing for efficiency in their commercial models. While this approach may not lead to higher market share in the short-term, it improves profitability and, over time, can provide brands with both brand equity and a steady revenue (and rebate) stream that can be deployed to expand into peripheral market segments.

Precise Integration of Market Access into Short- and Long-Term Forecasts

The challenges described above – in which organizations stick to a broad patient segment despite evidence that it will be unsuccessful – are frequently driven by pre-existing forecasts that cannot be achieved by targeting a narrower segment of the population. This puts commercial leaders in a bind: do they stick their necks out and communicate to senior management that prior forecasts were too rosy? Or, do they hold steady and hope for the best? The former requires deft internal political maneuvering while the latter kicks the can down the road and often ends in disappointment.

The best way out of this bind is to begin applying a more precise access lens to product forecasts early in their development. We frequently see early-phase forecasts in which a product’s market access assumptions imply 80% “favorable” access with a 20% total GTN discount, based on little evidence and without rigorous assessment. This may have been good enough for business in the past, but not in today’s environment. Conducting a more formal assessment of the future access landscape for pipeline products provides drugmakers with a more steely-eyed view of their portfolios’ commercial potential, enabling them to 1) more efficiently allocate investment dollars and 2) set their commercial teams up for success by providing them with targets based on realistic expectations of access (e.g., eligible patient population, approval rates, pricing threshold, and GTN discounts) 3) communicate more realistic expectations to outside parties. It is also a critical lens through which to view BD opportunities.

Incorporation of Market Access Resources into the Commercial Model through the Patient Journey

Market access resources can be among the most substantial investments a brand makes. Even without accounting for discounts, the investments across a HUB, field resource managers (FRMs), specialty pharmacies and payer account teams are meaningful. While all of these resources can be crucial in a brand’s success, they are often less-than-fully integrated into the sales and marketing model. One of the most frequent issues that we come across is that roles and responsibilities across sales reps, FRMs and the HUB (among others) are unclear. This leads to inconsistent communication across customers, duplicative outreach to the same individual at HCP accounts, and a sub-optimal use of patient support resources. Given that many of these resources are treated as relatively fixed costs to the organization, making the most efficient use of them can improve both top- and bottom-line performance.

The largest area that we see the industry struggling with here is defining how these pieces of the puzzle fit together. What is the optimal way for a sales rep-FRM dyad to approach an office? What types of information should be communicated by whom, and when? What is the best process for information sharing? Contextualizing these questions within the patient journey can help organizations to ensure that these types of market access considerations are efficiently integrated into the commercial model.

In Summary

Despite continuing to push the frontiers of science and technology, the changing economics of the biopharmaceutical industry have put downward pressure on the industry’s attractiveness to investors. While many factors are at play, a more challenging US market access environment is among the most impactful. Given the nature of the challenge, organizations should be looking to add a market access lens into how they evaluate the potential of their assets, how they define commercial strategy, and how they execute their commercial operations. Doing so effectively can help them to change the current industry narrative by doing more with less.

Sources

[1] Yardeni Research via I/B/E/S data by Refinitiv; S&P Global; Hayden Consulting Group analysis

[2] Sector forward P/E relative to S&P 500 forward P/E (forward P/E based on 12-month consensus expected operating earnings per share; as of December 30, 2023)