Keeping Your Cool in a Warming M&A Market

Integrating US Market Access into Biopharma Acquisition Evaluation

Unlock Success

02/07/2024

Read time: 7 min

A Ripe Environment

2023 and the early stages of 2024 have brought several positive surprises for the US economy. Gloomy forecasts of recession appear to be in the rearview mirror, and the prospect of a “soft landing” seems more realistic than ever. While reeling markets, higher interest rates, and an emboldened FTC were at one point dampening M&A activity, the stock market has roared back to life and much of activity at last month’s JPM conference was once again centered around deal-making. As the market comes out of a deep freeze, an estimated $1.4 trillion in dry powder1, an impending patent cliff worth nearly $250 billion in annual net sales1, and relatively low sector valuations should create an environment that is ripe for deal-making.

Combine these demand drivers with strained supply – the industrywide R&D replenishment rate is expected to drop by 50% in the next five years2 – and those valuations may start to get stretched during transactions. Against this backdrop, it will be important for acquirers to remain disciplined in their approach to evaluating acquisition targets.

One key ingredient in maintaining this discipline is an accurate assessment of the asset’s market access profile. Several organizations that we see struggling today are dealing with the consequences of unrealistic access assumptions that resulted in overly optimistic views of acquisitions’ commercial potential. These views not only lead to overvaluation, but hamper organizations’ commercial execution as the process of coming to terms with a misjudged forecast can be politically fraught and take time and energy away from key planning activities. All of this ultimately leads to value destruction.

Maintaining Discipline

The typical approach that we see organizations use when assessing an asset’s US market access profile is to assume some level of list price, gross-to-net, conversion (a catch-all that converts written demand to filled patients) and adherence. This translates written demand into dollars.

The framework is a good one, but creating accurate estimates is not always straightforward. Analogs are undoubtedly a valuable resource, but can lead to inaccurate assumptions if they are misused. Understanding the market access capabilities required to commercialize a drug is critical, but not always well-understood at the point of acquisition.

While the challenges can vary based on the unique nature of certain assets, we believe that five key considerations can help organizations to avoid the most damaging pitfalls that we generally encounter:

1. Ensure an Accurate Understanding of Whether the Product Will be Medical or Pharmacy Benefit:

Whether the product will be covered under the pharmacy benefit or the medical benefit lays the foundation for all other components of a brand’s market access evaluation. The brand’s positioning, pricing, and GTN assumptions (for both payers and providers), along with a market access capabilities assessment should all be developed with an understanding of this dynamic.

Fortunately, this is often obvious based on where and how the product is administered, as well as competitive analysis. More challenging situations can arise in certain cases, such as novel non-infused HCP-administered products and treatments that span both inpatient and outpatient settings. When this is in doubt, a rapid round of payer research is worth the investment given the importance of this dynamic.

2. Pick a Relevant Pricing Benchmark:

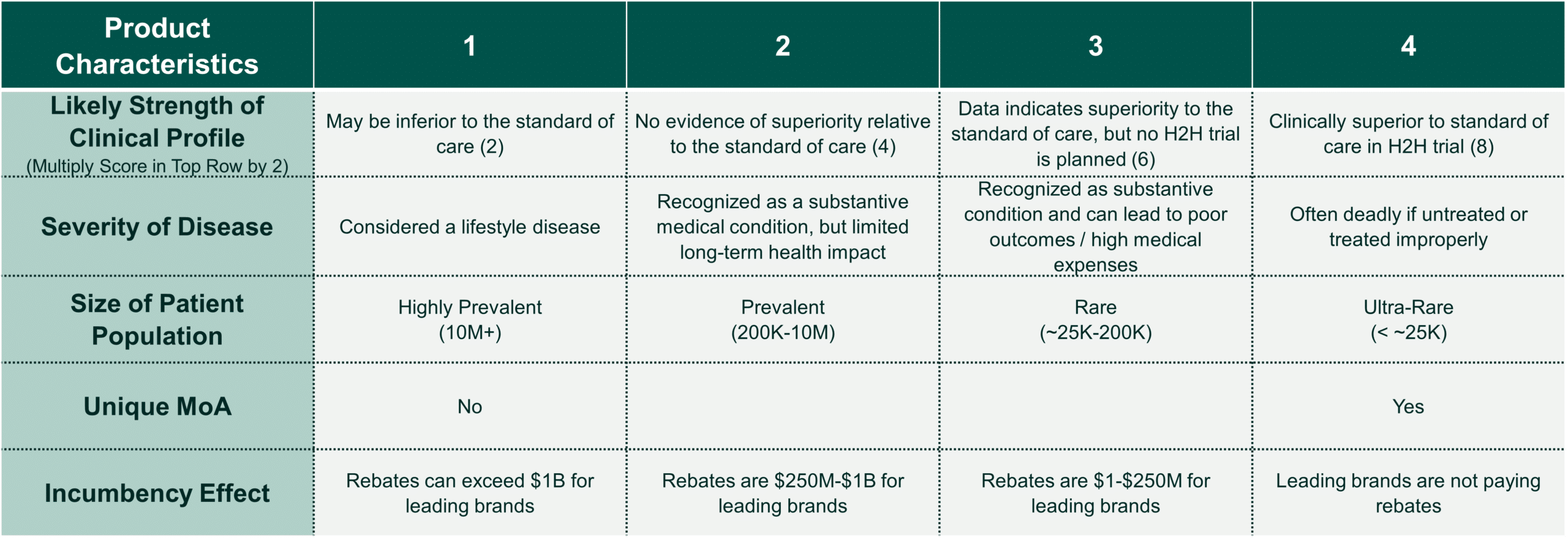

When it comes to pricing assumptions, the best pricing benchmark is often the standard of care in target’s therapeutic area. If the target treats a condition with no relevant pharmaceutical treatments, the speed of evaluation often precludes a thorough HEOR analysis. In this case, selecting a first-in-class analog with similar attributes in the following categories can help organizations develop a ballpark estimate of pricing and access assumptions:

- Likely strength of clinical profile relative to non-pharmaceutical standard of care

- Severity of disease

- Population size

- Benefit under which the drug is covered (e.g., medical vs. pharmacy)

- Type of therapy (e.g., small molecule, biologic, gene therapy, etc.)

Additional details regarding how to think about some of these categories can be found below.

3. Take a Sober Perspective of Pricing Power and Payer Management:

Clinical innovation does not always equate with value. Some of the biggest mistakes we have seen teams make is that their clinical convictions crowd out thinking around how payers will manage an asset. While market research can be useful in illuminating how payers may approach an asset, the pace of the due diligence process can create constraints around timing. In these instances, we recommend assessing the product based on the framework below:

For assets using a competing treatment’s price as a benchmark, this scoring system can be used to evaluate the product’s relative pricing power (for first-in-class products, net pricing assumptions can be developed by choosing analogs that fit well in the categories in #2):

- Brands that score 19+ have exceptional price power. These products can likely be launched at a meaningful net price premium relative to the benchmark (likely 10-20%, net of rebates to payers) while obtaining broad access within the drug’s target patient population.

- Brands that score between 16 and 18 have strong pricing power. These brands can likely achieve a small premium (5-10%) while obtaining broad access within the drug’s target population.

- Brands that score between 12 and 15 have fair pricing power. Achieving broad access within the drug’s target patient population will likely require net price parity with the most relevant competitor (at best). In markets that are more tightly managed, the need for additional discounts and considerations around access by line of therapy should be evaluated.

- Brands scoring 11 or lower have weak pricing power. They will likely require discounts relative to the benchmark and even still may be used only in refractory patients.

These guidelines are admittedly subjective, and we would encourage teams to adjust this framework and evaluation based on target-specific circumstances (if the most relevant pharmaceutical competitors are generics, for instance, the pricing premiums and definitions of “broad access” above should be closely scrutinized). However, careful consideration of the factors above can help teams to hone in on the most critical dynamics that will impact a target’s pricing power.

4. Deconstruct the Asset’s Anticipated GTN Profile:

Platforms such as IPD Analytics that allow teams to quickly estimate analogs’ gross-to-net can be a boon when evaluating an acquisition target, but they must be used carefully. For any target, we would recommend going through major GTN line items and ensuring that any analogs being used share similar dynamics to the target across key GTN drivers. These include whether the product is medical benefit or pharmacy benefit, payer rebates, physician discounts, 340B exposure, patient affordability programs (quick-start/bridge, copay card, PAP) and statutory rebates in government channels. Payer mix is a critical input as the impact of savings programs, Medicaid rebates, Medicare benefit design payments and government-mandated CPI penalties will be highly sensitive to these assumptions.

5. Consider the Fit with the Organization’s Existing Market Access Capabilities:

In some cases, acquiring a new product can stretch the existing capabilities of an organization’s market access team. Critical questions that teams should be looking to understand include:

- Do we need to engage with new types of institutional customers to market this product?

- Do we need to offer new types of customer support to drive a strong patient experience (e.g., HUB services, FRM resources)?

- Will we need to set up a new type of distribution model to support availability?

- Will we have to start discounting to HCPs and managing ASP?

- (If the product is medical benefit): Do our HCP customers have the experience, infrastructure, and financial incentive to administer and ensure reimbursement for this product?

While any gaps in these areas should not disqualify an asset from consideration, they should be accounted for in its assessment and flagged as areas for development should the asset be acquired.

Stay Cool

Given the recent increase in M&A and ongoing supply-demand imbalance for new assets, many biopharmaceutical organizations may soon find themselves under pressure to make deals. Discipline in assessing how a product’s market access profile will impact its commercial success will be critical in helping teams to keep their cool and sort out the winners from the losers.

Sources

[1] “Big Pharma’s Patent Cliff is Fast Approaching”; The Economist (April 20, 2023)

[2] EY via “The ‘Innovation Gap’ Haunts Big Pharma”; PharmaVoice (April 28, 2022)