Efficiency Gains

Re-Framing Biopharma’s Approach to Marketing Efficiency

Unlock Success

02/21/2024

Read time: 7 min

Measuring Efficiency Efficiently

We have written previously about the growing importance of efficiency in today’s biopharmaceutical industry and of market access’s role in helping to drive it. But while efficiency is easy to conceptualize, creating clear metrics to measure it can be more challenging. One high-growth industry that has managed to achieve this is Software-as-a-Service (SaaS). Its preferred gauge of efficiency – Lifetime Value (LTV) : Consumer Acquisition Cost (CAC) – has lessons for drugmakers grappling with new and daunting challenges around increasing R&D costs, reduced pricing power and regulatory scrutiny.

Hayden’s preferred approach to measuring this ratio is:

LTV : CAC is effectively the return – the patient’s financial value once the first prescription is written – on a brand’s marketing investment – the dollars spent acquiring that first prescription. The role of LTV : CAC in measuring marketing efficiency is thus fairly straightforward. Efficiency is improved by either:

- Minimizing the cost of acquiring a customer

- Maximizing the acquired customer’s lifetime value

The higher the LTV : CAC ratio, the greater the return on the marketing dollars invested in the brand.

A Brief Illustration

Three brief examples can help to illustrate how this ratio shifts in real-world situations, and highlight the implications that these shifts can have on manufacturers’ decision-making:

1. New Competitive Entrants:

Competitive entry is almost certain to affect a brand’s LTV : CAC ratio. LTV is likely to decline as the emergence of new competitors provides customers with additional opportunities to switch products, while payers can leverage additional competitors to extract greater rebates. CAC is likely to increase as intensifying competition means that a constant level of marketing investment is likely to yield fewer new patient starts, as customers have another option to choose from. A declining LTV combined with an increasing CAC pinches LTV : CAC from both sides, indicating that the brand’s return on its marketing investment will fall.

2. Market Saturation:

Market saturation may not impact LTV, but it is likely to impact CAC. As markets mature, marketing budgets are likely to experience diminishing marginal returns as the population of untreated patients begins to decline. This is likely to lead to increasing CAC as the same marketing dollar has less of an opportunity to attract new patients, which will in turn drive LTV : CAC lower.

3. Loss of Exclusivity:

Absent an adjustment in a brand’s marketing budget, loss of exclusivity will negatively impact LTV : CAC. LTV is almost certain to decline as the availability of generics or biosimilars creates margin pressure and opportunities for switching. A constant marketing budget would result in increased CAC due to generic substitution.

The fact that competitive entry, market saturation and loss of exclusivity lead to lower returns on marketing investments is not a surprise. However, the value of the LTV : CAC ratio is that it provides commercial leaders with a simple-to-understand quantitative measurement that they can use to assess the relative profitability of different brands and geographies over time. This can help them to make more efficient decisions when determining how to invest fixed budgets.

Right-Size Me

One clear area in which LTV : CAC can help commercial organizations to become more efficient is to provide a quantitative measure of how marketing budgets should be allocated between brands. Brands with high LTV : CAC should receive greater levels of marketing investment (both personal and non-personal promotion) than those with a lower ratio. While it is possible that strategic considerations around long-term portfolio growth influence decision-making in a way that the LTV : CAC ratio cannot effectively capture, LTV : CAC can serve as a valuable signal to indicate when organizations are over- or underinvesting in certain assets.

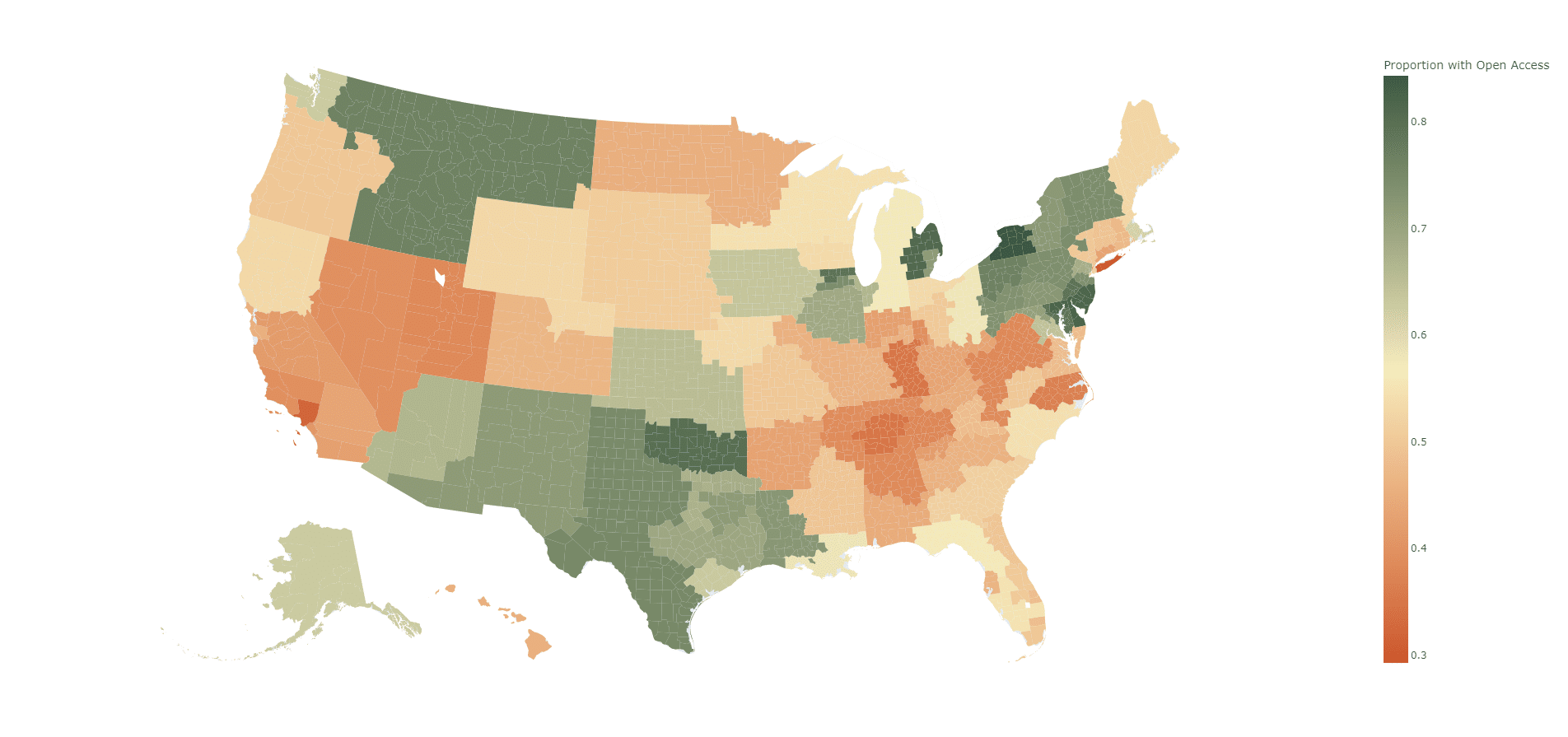

Another high-value area of LTV : CAC deployment is determining where to allocate marketing budget for a given brand. Access and GTN conditions are often the largest drivers of LTV and often vary meaningfully by geography, making some regions of the country better investments than others. This is demonstrated by the map below, which depicts a blinded example of how LTV : CAC can vary geography:

LTV : CAC demonstrates that for this brand, investing the same amount of marketing budget per person in Florida as in Texas will yield a lower overall return than skewing marketing investments towards Texas. Deconstructing the impact of LTV vs. CAC on the relative measures between geographies is another critical consideration before making investment decisions: is outperformance of one area over another due to greater LTV (often driven by improved access conditions or better GTN with a major PBM in a market) or due to lower CAC (perhaps driven by a particularly effective sales rep)? Greater LTV signals that a greater marketing investment is warranted, while a lower CAC – pending the reason – may mean that greater allocation of marketing budget is not required. For example: if a sales rep is driving low CAC due to their ability to generate prescriptions, additional marketing spend may be wasteful. However, if it appears as though DTC in a given geography is particularly effective, increasing its reach is more likely to be an effective investment.

Efficient, but Not Frictionless

This begins to highlight one of the key hurdles that organizations face in deploying this type of geographic approach: incentive compensation. Increasing marketing investment in areas with favorable LTV at the expense of others may be viewed as unfair within the sales organization unless IC structures are adjusted accordingly.

The solution to this challenge depends on where an organization sits in the evolution of its IC design. For organizations marketing brands whose access landscape varies meaningfully across the country, a standard IC structure in which all reps are compensated based on the same per-Rx (or per-patient) amount is uneven to start with. For organizations who operate under this model, adjusting incentive compensation based on access conditions is likely a pre-requisite to succeeding in a world where LTV : CAC is used to make investment decisions (and should be done regardless of whether LTV : CAC is used as a metric). For organizations who have already adopted access considerations into their IC models, continuing to adjust them to reflect geographical differences in marketing investment is likely a tinker rather than a wholesale change. Both pilots and data from prior experience can help organizations to understand the impact that adjustments to marketing investments may have on performance, and can help to inform teams how IC should adjust based on geographic investment. The same holds true for organizations whose brands enjoy relatively consistent access across the country.

Another challenge is measurement. While the part of LTV : CAC’s beauty is in its simplicity, calculating it can be more complex. The data used to calculate these metrics can be siloed across different pieces of the organization. The calculation of CAC requires that cost accounting best practices be taken into account when allocating spend from shared marketing resources to specific brands. LTV calculations should include not only conversion, lifetime compliance and GTN, but all costs that are required to help patients initiate and remain on therapy (HUB, FRM, SP service fees, etc.). Allocating these costs requires its own cost accounting methods. Simple math and assumptions can typically be used to get decent assumptions, but greater levels of precision require more rigorous cost allocation methodologies.

While both of these hurdles represent challenges, allowing them to impede the implementation of LTV : CAC-based decision-making is letting the tail wag the dog. They can both be overcome with solid analytical approaches, clear communication and strong leadership.

Doing More with Less

Implementing an LTV : CAC-based approach to decision-making is core to a more efficient marketing approach. Allocating a great share of marketing spend to brands and geographies where LTV : CAC is high at the expense of those where it is low is a clear path to improving the long-term profitability of brands and portfolios. In an environment in which financial markets are demanding that biopharmaceutical manufacturers learn how to do more with less, LTV : CAC provides drugmakers with a rock solid foundation to drive efficient investment decisions.