The Inflation Reduction Act – Part III

Hayden CG

Untangle Complexity

10/17/2022

Read time: 11 min

Background & Context

On August 16th, 2022, President Biden signed the Inflation Reduction Act (IRA) into law, with a primary goal of lowering prescription drug costs in Medicare. The IRA seeks to achieve this goal through three main provisions: government negotiation of Medicare drug prices, penalties on Part B and Part D medicines with prices growing faster than inflation, and a redesign of the Part D benefit.(1) HCG is focused on the implementation of the drug negotiation program in 2026.

In our first paper, we reviewed unknowns surrounding implementation and highlighted which therapeutic areas and manufacturers are likely to be impacted first. In our second paper, we further evaluated the impact of the drug negotiation program (DNP) by exploring a scenario of interest where one product in a therapeutic area was subject to government negotiation. In this paper, we continue to unpack the anticipated impact of the DNP on competitive dynamics in Medicare Part D by looking at how the implications discussed in our first scenario evolve when two brand drugs in a therapeutic area are subject to government price negotiation (hereafter referred to as DNP brands).

Scenarios of Interest:

- Therapeutic Area with One Government Negotiated Brand

- Therapeutic Area with Two Government Negotiated Brands (today’s focus)

- Therapeutic Area with a Government Negotiated Brand in Medicare Part B

Scenario #2 – Therapeutic Area with Two Government Negotiated Brands

For the next scenario, HCG will discuss an illustrative therapeutic class with three brand drugs, two of which become subject to government price negotiation in 2026. HCG will assume the following:

- List Price: All three drugs have a monthly Wholesale Acquisition Cost (WAC) of approximately $500 (annual WAC of approximately $6,000).

- Competition: The market is predominantly comprised of the two DNP brands, Drug 1 and Drug 2, with a 60% and 30% market share in Medicare, respectively. Clinical differentiation is limited from an efficacy perspective; however, Drug 3 has an inferior safety profile.

- Rebates: This is a competitive class with moderate to high discretionary rebates. HCG will assume that Drugs 1, 2, and 3 provide rebates of 60%, 30%, and 10% of WAC, respectively, prior to IRA implementation.

- Maximum Fair Price: Drug 1 and Drug 2 qualify as extended-monopoly drugs, meaning that the ceiling for government negotiation begins at the lesser of (1) 65% of the non-federal average manufacturer price (non-FAMP); or (2) the Medicare net price. As mentioned in Papers 1 & 2, HCG assumes that non-FAMP is 80% of WAC.(2,3) Although HHS can offer a negotiated price below this ceiling price, for modelling purposes HCG will assume the Maximum Fair Price (MFP) is equal to the ceiling price.

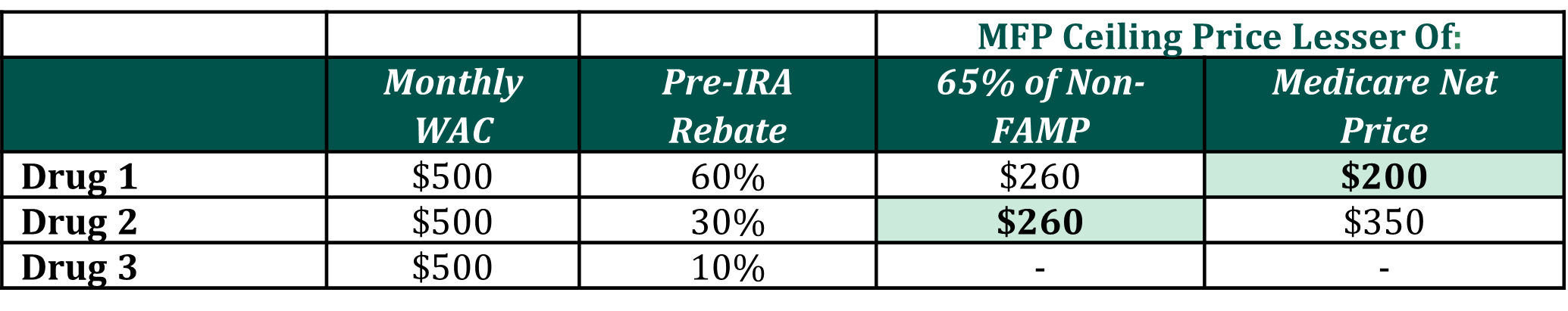

The varying levels of historical rebates across the three drugs has introduced an important implication for our analysis. As noted above, under the IRA the ceiling for government negotiation for extended-monopoly drugs must be the lesser of: (1) 65% of the non-federal average manufacturer price (non-FAMP) or (2) the Medicare net price. As Figure 1 shows, if Drug 1 provides a 60% rebate, its Medicare net price is the lesser of the two pricing benchmarks, meaning that its monthly MFP ceiling price will be set at the Medicare net price of $200 rather than $260. For the other DNP brand, Drug 2, the monthly MFP ceiling price remains at $260, making Drug 2 a more costly option for the plan relative to Drug 1.

Figure 1: Differential Impact on MFP Ceiling of Existing Discretionary Rebating

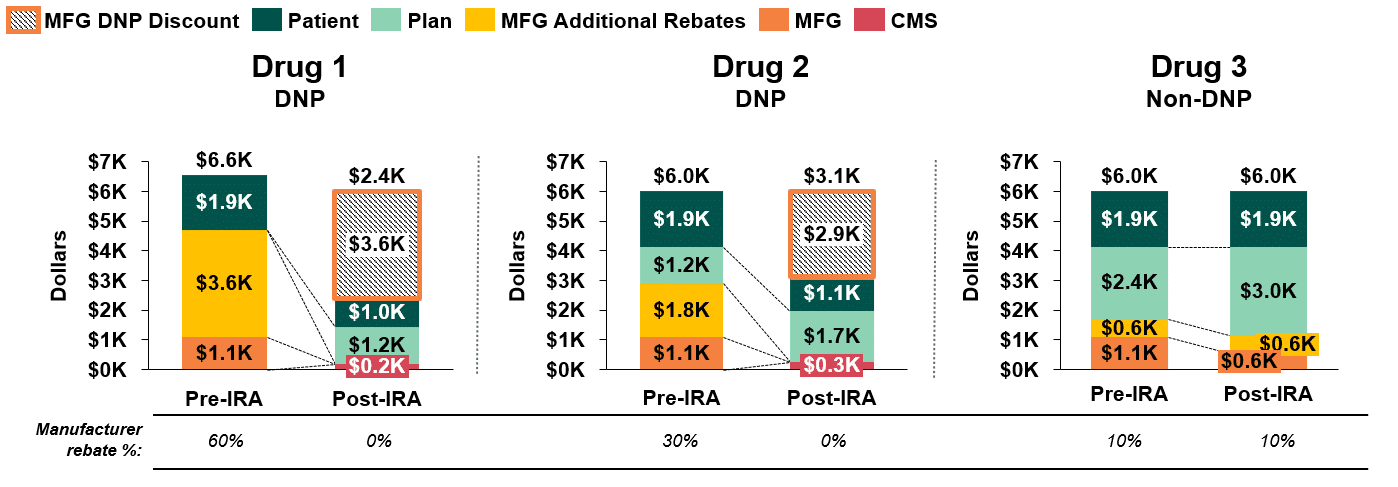

Figure 2 compares annual stakeholder liability pre- and post-IRA implementation for the three brand drugs in the class. Irrespective of negotiation status, plans are likely to face increased net liability for all three drugs due to structural changes in the Part D benefit. If the DNP brands provide no discretionary rebates to further offset costs and Drug 3 keeps its existing rebating threshold at 10%, Drug 1 is likely to become the sole preferred brand, as it offers the lowest annual net cost to the plan ($1.2k vs. $1.7k vs. $3.0k).

Figure 2: Comparison of Annual Stakeholder Liability Pre- and Post-IRA Implementation (4,5,6)

Unlike the scenario considered in our prior whitepaper (link to Paper #2), patients in our second scenario do not reach the catastrophic phase of Part D coverage today, nor will they hit their annual out-of-pocket maximum of $2,000 post-Part D redesign (unless they are taking other drugs concomitantly). This introduces two unique dynamics that were not present in our previous scenario:

- Patient Liability: As demonstrated in Figure 2, annual patient cost sharing for a DNP drug will be considerably lower than for a non-DNP drug ($1.0k & $1.1k vs $1.9k) following implementation of the IRA. This is because patient cost sharing is based on different cost benchmarks for DNP and non-DNP drugs. Patient cost sharing is benchmarked to the MFP for DNP drugs versus a retail price close to WAC for non-DNP drugs. Importantly, because the retail price benchmark for non-DNP drugs does not account for the discretionary rebates paid by manufacturers, patient cost sharing is based on the full price of the drug, rather than the discounted net price paid by the plan.

- Plan Liability: The magnitude of difference in net plan liability between DNP and non-DNP drugs is fairly narrow ($1.2k & $1.7k vs. $3.0k).

Figure 2 demonstrates the likelihood that plans’ net costs will increase post-IRA, even when factoring in the DNP discount for government negotiated drugs. This is due to changes in stakeholder liability under the Part D redesign, as well as the assumed loss of discretionary manufacturer rebates on drugs subject to government negotiation. If the DNP brands provide no discretionary rebates to offset costs, and Drug 3 maintains its existing rebating threshold at 10%, Drug 1 and Drug 2 will represent lower net cost options for the plan.

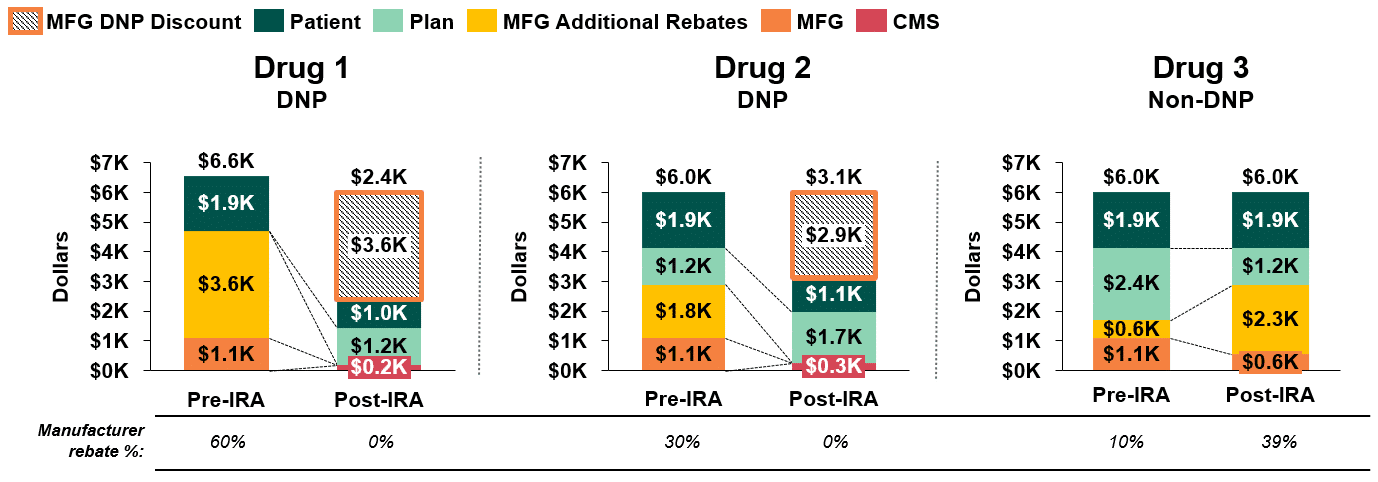

Alternatively, Drug 3, a non-DNP product, could alter this competitive dynamic and achieve a lower net price for the payer by offering a discretionary rebate greater than or equal to the value of the DNP discount for Drugs 1 and 2. For example, as demonstrated below in Figure 3, a discretionary rebate of 39% would yield a net plan cost of $1.2k for Drug 3, which is comparable to the net cost of DNP Drug 1 and lower than that of DNP Drug 2.

Figure 3: Stakeholder Liability Comparison Pre- and Post-IRA Implementation(4,5,6,)

It is also worth noting that in this example, the lower plan liability for Drug 3 is, in part, driven by higher patient out-of-pocket costs for non-DNP products (since cost sharing for non-DNP products is based on a retail price close to WAC that doesn’t reflect manufacturer rebates). Therefore, while net plan liability would be comparable for Drug 1 and Drug 3, patients would face significantly higher out-of-pocket costs for Drug 3 than for Drug 1.

Plan & Manufacturer Considerations

Plans are likely to head into the Medicare contracting cycle seeking to offset the increase in liability due to the IRA’s structural changes to the Part D benefit. Some of this increased cost could be addressed through higher premiums, but plans can also achieve lower net costs by reducing the utilization and/or net cost of non-preferred drugs through the following tactics:

- Formulary Exclusions: Part D plans are required to cover a minimum of two drugs per therapeutic class.(7) Per the IRA, all DNP brands must have formulary coverage, and therefore cannot be excluded. These restrictions would allow plans to exclude Drug 3 from the formulary, which is likely to be the most effective strategy to offset budgetary risk for the plan (unless Drug 3 offers high discretionary rebates to secure access).

- Utilization Management (step edits, prior authorizations, tiering): Restricting access or advantaging products against one another could serve to funnel patients to the lowest cost option(s) for the plan. This would shrink utilization of non-preferred drugs while allowing prescribers and patients slightly more choice across the class than outright exclusion of a non-DNP brand.

- Extract Discretionary Rebates: Finally, plans could extract rebates from one or more brands to further reduce plan liability (irrespective of the drug’s negotiation status). While this wouldn’t reduce utilization of non-preferred drugs, it would offset plan costs incurred by patients who chose to take non-DNP (or more expensive DNP) brands.

Concurrently, manufacturers must determine if and how they plan to compete for formulary access. DNP brands must determine if discretionary rebates are required to achieve advantaged access. Non-DNP brands will also be challenged to compete. HCG posits that for non-DNP brands to compete effectively, they would need to have a comparable clinical & safety profile and be willing to provide discretionary rebates such that their net price to the plan is competitive to at least one of the DNP brands.

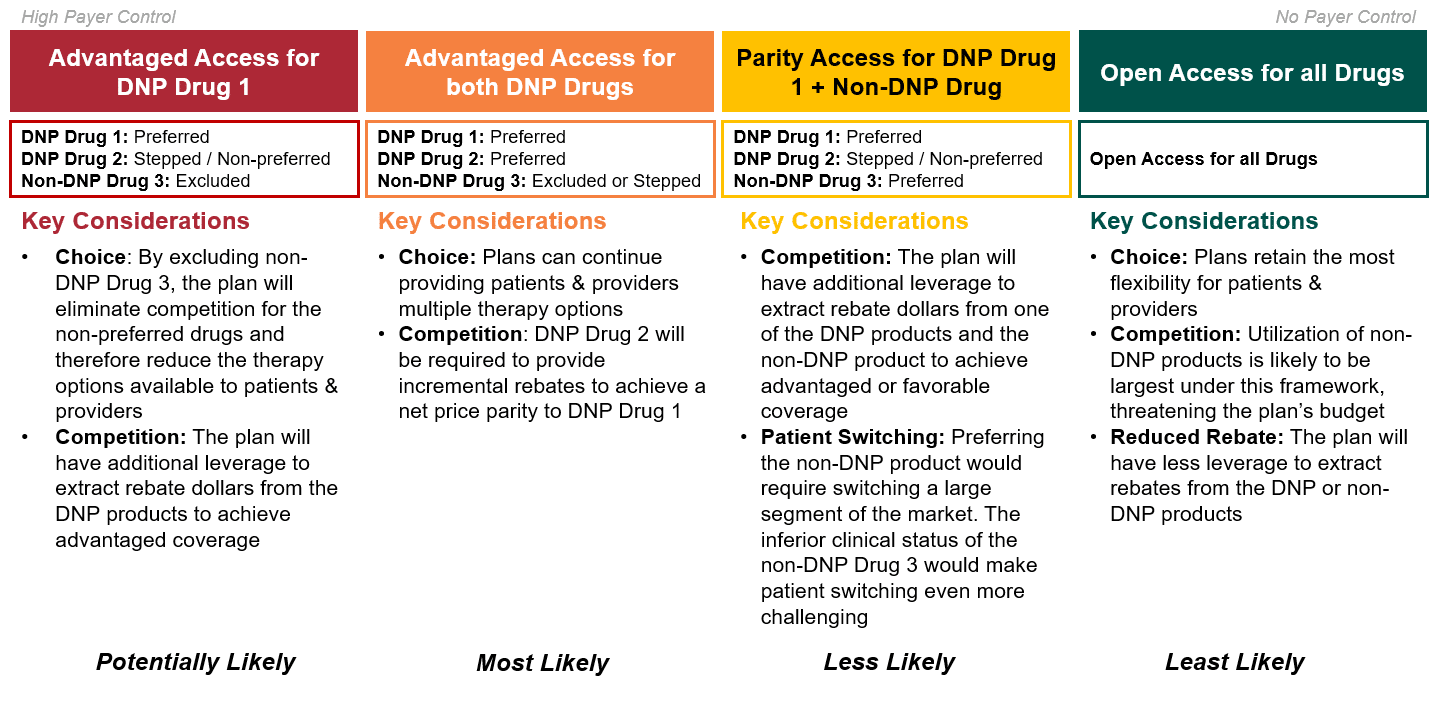

Theoretically, non-DNP brands could also compete if they had superior clinical differentiation. However, because drugs are selected for government negotiation based on total expenditure and volume, this is likely only relevant for newly launched brands. Ultimately, given its inferior safety profile and limited market share, HCG assumes that Drug 3 will not be able to effectively compete against the DNP brands – even if substantial discretionary rebating were provided. Accordingly, plans will most likely aim to extract discretionary rebates from the two DNP brands, while limiting access to the non-DNP drug (i.e., Drug 3). As highlighted below in Figure 4, given the market dynamics at play in this scenario, the most likely outcomes are those in which either one or both DNP brands are advantaged.

Figure 4: Strategic Access Options for Medicare Part D Plans

Key Takeaways & Next Steps

Implementation of the IRA will greatly impact Medicare Part D market dynamics, and the implications become increasingly complex when two brands in a therapeutic area are subject to government negotiation. While several takeaways remain consistent across the two negotiation scenarios reviewed in this series, there are a number of new anticipated market outcomes.

- Plan Liability: Given the structural changes under Part D redesign, plans are likely to take on increased financial liability for most drug classes. To reduce this liability in classes with multiple DNP brands, plans are likely to reduce the size of non-DNP volume through increased utilization management. Outside of the protected classes, plans will likely leverage formulary exclusions for non-DNP brands.

- Manufacturer Revenues: Manufacturers of non-DNP brands are likely to see substantially lower revenues due to plans’ increased use of formulary exclusion or utilization management to limit market share and/or demands for higher rebates to secure access. In addition to revenue losses from mandatory MFP discounts, manufacturers of DNP brands may experience further reductions in revenue if additional discretionary rebates are needed to compete for market share.

- DNP Brands: For classes with multiple DNP products, differences in the MFP for each product could force DNP brands to compete against one another. Even if HHS cannot differentiate MFP to drive utilization towards one drug, payers can leverage the difference in MFP to extract rebates from one of the DNP brands. In the scenario outlined in this paper, Drug 2 could provide discretionary rebates to achieve a parity net price to Drug 1 (thus, securing parity access).

- Non-DNP Brands: Non-DNP brands will need to offer higher discretionary rebates to gain formulary access, but this does not guarantee preferred formulary placement. For non-protected classes, non-DNP brands may need to offer steep discounts to avoid formulary exclusion.

In our next whitepaper, we will explore how the competitive dynamics in Medicare Part D evolve even further when Medicare Part B drugs become eligible for government negotiation in 2028. We will also explore how stakeholder incentives differ when all competing drugs in a class are covered by Medicare Part B vs. when drugs in a competitive set are spread across benefits.

Sources

[1] Although the Inflation Reduction Act refers to the program as a negotiation, HCG assumes that manufacturers will effectively be required to accept the government’s terms, given the penalty for non-compliance is so severe.

[2] “A Comparison of Brand-Name Drug Prices Among Selected Federal Programs,” Congressional Budget Office (Feb 2021)

[3] Klein, M., D’Anna, S., Klasner, J., Pierce, K., (31 Aug 2022). The Inflation Reduction Act: What’s Changing in Healthcare?

[4] Assumes DNP brands will not provide discretionary rebates post-IRA; Assumes a patient starts therapy at the beginning of the calendar year, and remains adherent to therapy; Assumes the patient has no other drug spend; For the pre-IRA implementation period, assumes (1) patient enters Initial Coverage Phase after Patient OOP exceeds $480; (2) patient enters Coverage Gap Phase after total drug expenditures exceed $4,430; (3) patient enters Catastrophic Coverage Phase after patient TROOP exceeds $7050; Modeling does not account for plans sharing a portion of rebates to reduce CMS reinsurance liability in the Catastrophic Coverage Phase

[5] The modeling of the post-IRA scenarios is done using the 2022 benefit design parameters

[6] For DNP Drug 1, the sum of patient cost sharing and manufacturer liability (including the 60% discretionary manufacturer rebate and the 70% statutory discount in the coverage gap) in the pre-IRA period exceeds the annual total WAC price of the drug ($6k). This results in a total annual payment to the plan of $6.6k for DNP Drug 1.

[7] Except in the six protected classes, where plans are required to cover all drugs in a therapeutic class.