IRA: Impact to Healthcare Provider Economics

In collaboration with Kirsten Axelsen, we discuss the downstream consequences of the Inflation Reduction Act's Drug Negotiation Program and how it will impact treatment choice, delivery of care, and practice economics for physicians.

Untangle Complexity

09/12/2023

Read time: 7 min

Potential Impact of the IRA on Medicare Part B Physician Economics

The Inflation Reduction Act (IRA) will permit the federal government to set a low price for physician-administered drugs in Medicare. As a result, physician practice payments for administering these drugs in the hospital outpatient and physician office setting will be reduced. Furthermore, Medicare-based pricing will influence non-Medicare physician reimbursement for administering medicines to outpatients, so the new law will have broader implications.

If faced with a reduction in reimbursement income resulting from the IRA, physicians and their practices will face several choices: 1) reduce the amount of outpatient drug delivery they make available to patients, 2) retain the same level of income by switching to drugs where the price is not negotiated, 3) refer patients to a different site of care for drug infusions such as a hospital, and focus on care delivery that is not affected by the law. All of these choices have the potential to reduce the availability of physician-administered medicines and may increase overall healthcare costs.

Current Provider Reimbursement Dynamics

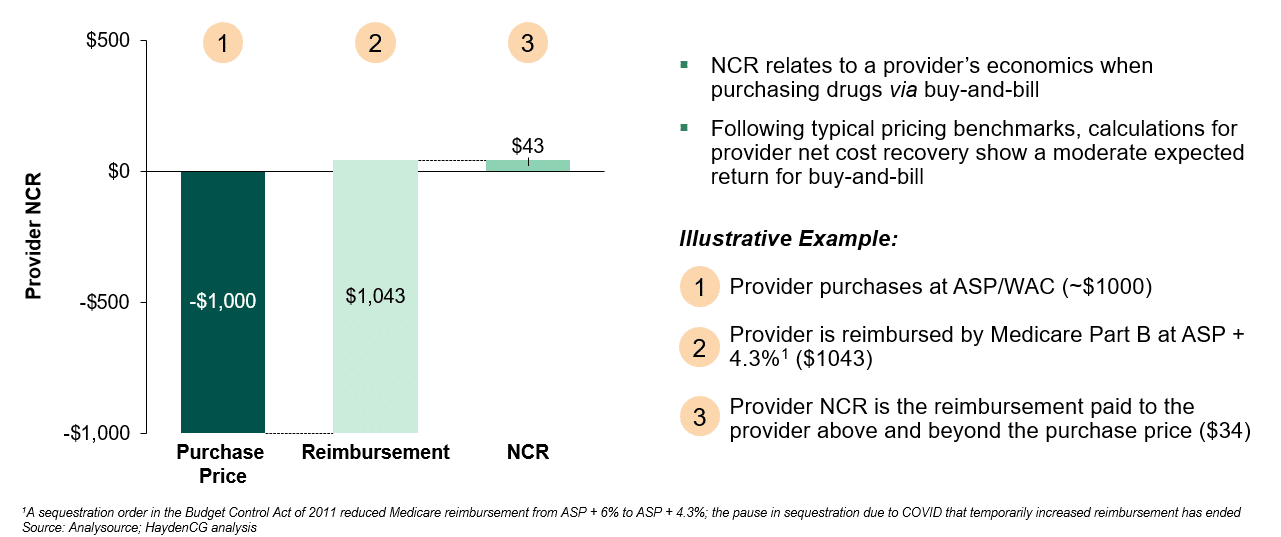

Under Medicare today, providers that administer medicines to patients in the outpatient setting through “buy-and-bill” are reimbursed at a defined rate based on Average Sales Price (ASP). ASP is reported by the manufacturer and reflects a drug’s sales price net of price concessions paid to U.S. purchasers, including discounts, rebates, and many other price reductions.(1) The healthcare provider buys a drug and is paid based on the ASP plus a markup once they administer the drug. The difference between a provider’s purchase price and the amount they are reimbursed is often referred to as the provider’s Net Cost Recovery (NCR). Positive NCR, as is illustrated in Figure 1, allows the practice to pay for the administrative and logistical requirements related to the acquisition of the drug, such as inventory, management, storage, and contracting.

Figure 1: Provider Buy-and-Bill Net Cost Recovery Calculation, Medicare Part B

Provider Reimbursement Changes Resulting from the IRA

Decrease in Physician Reimbursement for Medicare

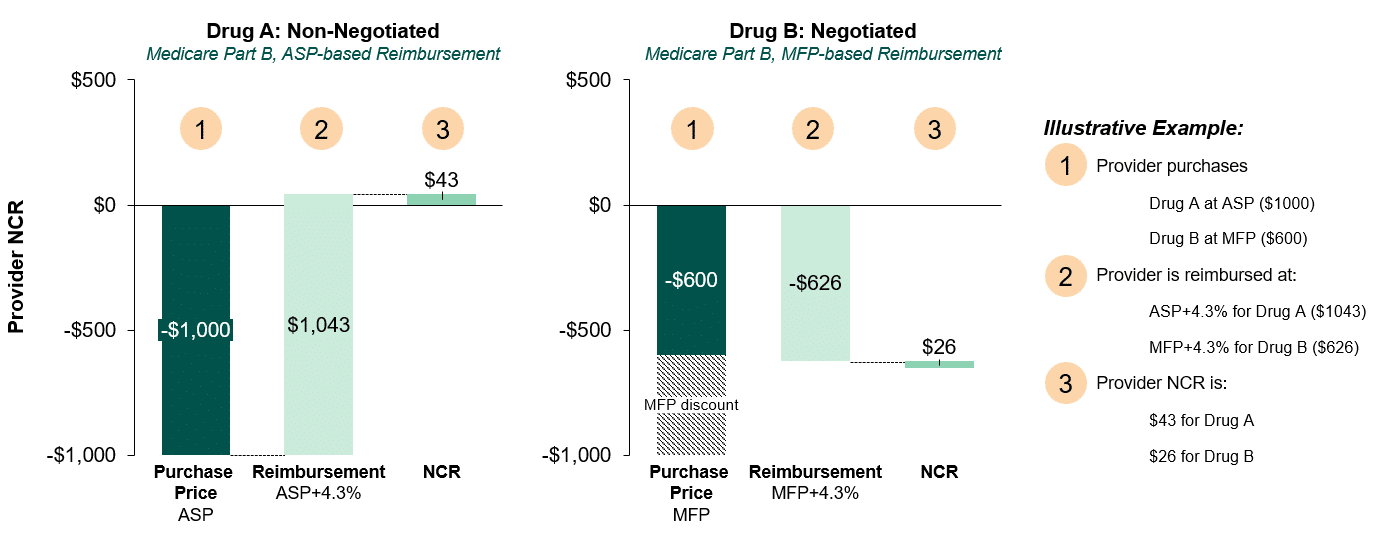

The IRA will establish a Maximum Fair Price (MFP) available in Medicare for selected medicines. For physician-administered outpatient drugs that are not subject to price setting, Medicare reimbursement will continue to be linked to ASP; however, for drugs subject to price setting, Medicare reimbursement will be based on the MFP. As highlighted in Figure 2, this change will result in a reduction in physician reimbursement (NCR) in Medicare. For example, if HHS negotiates a 40% discount for a drug – the defined starting point for negotiation – a physician will also observe a 40% reduction in NCR ($43 vs. $26) for Medicare patients.

Figure 2: Net Cost Recovery Calculation, Medicare Part B (ASP vs. MFP-based discount)

As a result of reimbursement dynamics defined in the IRA, provider NCR for negotiated drugs will be lower than similarly priced and discounted drugs within a competitive class.

Spillover to Provider Reimbursement in the Commercial Channel

In commercial insurance, there is more variation on the method utilized to determine provider reimbursement for physician administered drug delivery, however ASP is often the basis of reimbursement. In commercial insurance markups are often far in excess of 6%.(2) Manufacturers will continue to report ASP to the federal government, including all sales to Medicare. So, for products with an MFP, the ASP will be reduced. As a result, providers in the commercial channel whose reimbursement is connected to the ASP will see lower reimbursement, reducing their overall income, as their purchase price will not change. The reduction in ASP will be larger if the drug has a large proportion of sales in Medicare Part B, such as certain cancer or immunology treatments. If the ASP were to be reduced enough, such that it would result in a negative NCR in commercial, physicians may no longer find it economically tenable to be able to offer negotiated drugs to commercial patients.

Impact to Provider Reimbursement Changes Resulting from the IRA

The impact of the IRA on provider economics may result in changes in physician prescribing behavior, a decline in physicians offering buy-and-bill products, and a further acceleration of provider consolidation. Some physician practices rely substantially on the net cost recovery incurred through the buy-and-bill services they offer to support their offices. In 2014, more than 50% of oncology practice revenues was attributed to drug reimbursement, this has since increased to over 85% of revenue by 2022.(3,4)<,sup> Many of these offices offer critical services to patients, and even modest reductions in their NCR for offering physician-administered drugs could have serious ramifications to their practice economics, limiting their ability to stock or potentially administer buy-and-bill medicines to outpatients. It is estimated that the MFP in the IRA will reduce provider reimbursement for delivering medicines in office, typically by intravenous infusion, by 47% on average and by as much as 65% for oncology care physicians.(5)

When physicians’ offices face more challenging economics, their ability to remain independent may be constrained. This may result in consolidation with a larger practice, as provider groups seek the efficiency and security of affiliating with a larger organization with more ability to manage the risk of a reimbursement reduction. Independent provider consolidation with hospitals has been occurring at an increasing rate over the past decade, primarily driven by lower drug acquisition costs, the ability to demand higher reimbursement rates from commercial payers, and the ability to access manufacturers’ specialty networks with 340B pharmacies.(6) These drivers towards consolidation will become increasingly appealing for independent providers who will find their practice economics further challenged by the implementation of the IRA.

Considerations for Implementation of the IRA:

To mitigate the potential effects in the IRA on physician practices, policymakers may consider modifications to the law:

- Base provider reimbursement on the ASP prior to price setting for MFP drugs

- Exclude Medicare part B sales for medicines subject to the IRA from the ASP calculation

- Study the implications for provider practices as the law is implemented and report the findings publicly

If changes are not made to the implementation of the IRA there is substantial risk of negative consequences for patients seeking medications that require physician administration. In the U.S. healthcare supply chain, many providers are paid based on a percentage markup that is related to ASP. In the implementation of the IRA, policymakers should consider how the “Maximum Fair Price,” intended to bring costs down, may have the significant potential to increase costs. Providers whose practice income is heavily dependent on outpatient drug delivery, including in oncology or immunology, may stop providing that service, or shift to using higher cost drugs that do not have an MFP. As providers face a loss of income, they may also look to merge with hospitals or other healthcare systems to gain efficiency, spread risk, and set higher rates for reimbursement. This second order consequence of the IRA should be addressed and mitigated.

Sources

(1) Centers for Medicare & Medicaid Services. (23 March, 2022). Technical Guidance – Value-Based Purchasing (VBP) Arrangements for Drug Therapies using Multiple Best Prices. https://www.medicaid.gov/prescription-drugs/downloads/mfr-rel-116-vbp.pdf

(2) Sullivan, M, Urgo, R & Isaiah, E. (2021, December 10). BBBA Negotiations for Part B Drugs Raises Operational Questions. Avalere. https://avalere.com/insights/bbba-negotiation-for-part-b-drugs-raises-operational-questions

(3) Polite BN, Ward JC, Cox JV, Morton RF, Hennessy J, Page RD, Conti RM. Payment for oncolytics in the United States: a history of buy and bill and proposals for reform. J Oncol Pract. 2014 Nov;10(6):357-62. doi: 10.1200/JOP.2014.001958. PMID: 25398955; PMCID: PMC4223709.

(4) Schaedig, Cass. “Navigating Buy-and-Bill: What Every Practice Should Monitor and How Data Analytics Can Help.” AmerisourceBergen, 27 May 2022, https://www.amerisourcebergen.com/insights/physician-practices/navigating-buy-and-bill.

(5) Fein, A. (2021, August 11). Part B Update: Hospitals Keep Displacing Physicians – And More Practice Acquisitions Loom. Drug Channels. https://www.drugchannels.net/2021/08/part-b-update-hospitals-keep-displacing.html.

(6) Avalere IRA Medicare Part B Negotiation Shifts Financial Risk to Physicians, November 2022, accessed https://avalere.com/insights/ira-medicare-part-b-negotiation-shifts-financial-risk-to-physicians