The Inflation Reduction Act – Part IV

The final installment in a series covering the Medicare drug pricing reforms enacted by the Inflation Reduction Act.

Untangle Complexity

10/24/2022

Read time: 15 min

Background & Context

Throughout this series, our team has reviewed the impact of government price negotiation in Medicare following the implementation of the IRA’s Drug Negotiation Program (DNP).(1) In our prior installments, we’ve discussed key implications of the legislation, along with the anticipated competitive dynamics for pharmaceutical drug classes in Medicare Part D. Throughout this paper, we will explore the impact of the DNP in 2028, when drugs administered by providers in the outpatient setting, which are covered by the Medicare Part B benefit, also become eligible for negotiation.

Scenarios of Interest:

- Therapeutic Area with One Government Negotiated Brand in Medicare Part D– Link to Paper 2

- Therapeutic Area with Two Government Negotiated Brands in Medicare Part D – Link to Paper 3

- Therapeutic Area in Medicare Part B (today’s focus)

We will discuss the key stakeholder incentives at play post-IRA, including prescriber reimbursement dynamics, potential payer contracting strategies, and manufacturer competitive dynamics in Medicare Part B. An important consideration is the extent to which Medicare Part B drugs can be managed given CMS coverage requirements. Beneficiaries can choose to receive their Part B benefits from traditional fee-for-service (FFS) Medicare or Medicare Advantage (MA) plans, which are offered by private insurers.(2) The ability to implement Part B formulary controls in FFS Medicare is limited, as FFS plans are unable to employ step therapy and can only implement prior authorization or formulary blocks in rare instances (i.e., through the Self-Administered Drug list or claim edits). In contrast, as of 2019, Medicare Advantage plans may implement step edits & prior authorizations. However, even when brands can be managed against one another in Medicare Advantage, the extent to which manufacturers compete via discretionary rebates is limited.(3) When reviewing the impact of the DNP in Medicare Part B, HCG will account for these parameters, assuming that any competitive rebating will be limited to Medicare Advantage.

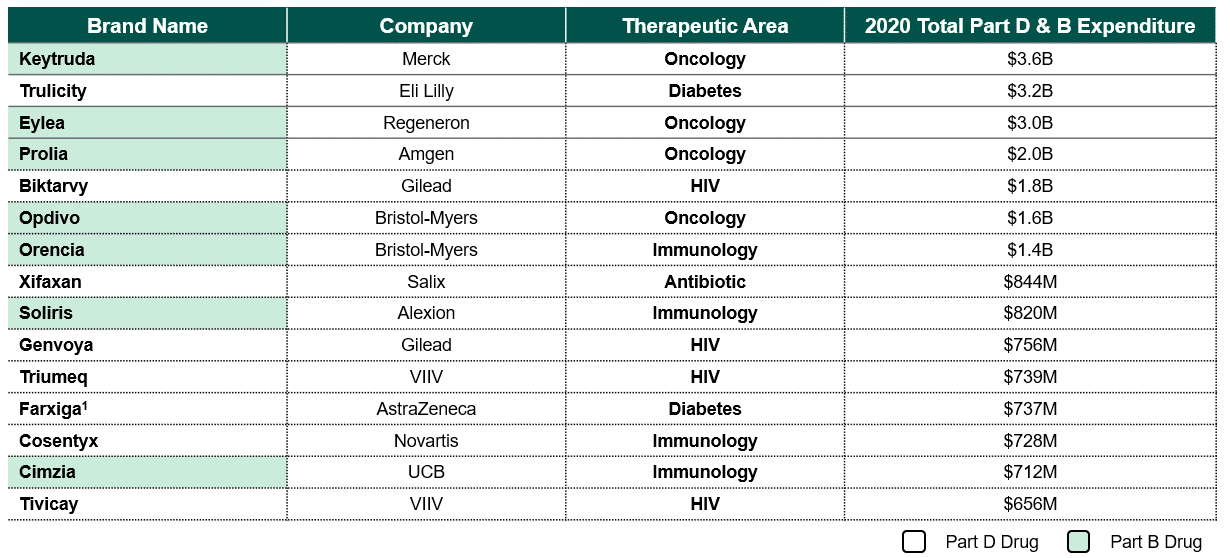

Based on 2020 Medicare expenditures, the therapeutic areas most likely to be impacted by the DNP in 2028 include oncology and immunology (see Figure 1).(4) Notably, these treatment areas contain multiple competitors across the pharmacy and medical benefits, each with unique indications and clinical data making it challenging for plans to use these products interchangeably.

Figure 1: Projected 2028 DNP Eligible Drugs in Medicare Part B and Part D (5,6)

Negotiation Scenario #3 – Two Negotiated Brands in Medicare Part B

For the third scenario in the series, HCG will review an illustrative class with three provider-administered drugs reimbursed under Medicare Part B, two of which are eligible for government drug price negotiation in 2028 (hereafter referred to as DNP brands). HCG will assume the following:

- List Price: All three drugs have a monthly Wholesale Acquisition Cost (WAC) of approximately $15k per month. In Part B, most providers are reimbursed based on a drug’s Average Sales Price (ASP), which is a U.S. government pricing benchmark defined as the weighted average of the price sold to all U.S. purchasers net of any discounts. For modelling purposes, HCG assumes discounting is minimal in this class, with WAC equal to ASP.

- Competition & Differentiation: Today, the market is predominantly comprised of the two DNP brands, Drug 1 and Drug 2, with a 55% and 25% market share in Medicare, respectively.

- Differentiation: All brands in this class are similar from an efficacy perspective.

- Maximum Fair Price: Drug 1 and Drug 2 qualify as extended monopoly drugs, meaning that the ceiling for discounting begins at 65% of the non-FAMP.(7) HCG assumes that the non-FAMP is 80% of WAC.(8,9) While HHS can offer a negotiated price below this ceiling price, for modelling purposes, HCG assumes the Maximum Fair Price (MFP) is equal to the ceiling price, resulting in a 48% discount from WAC ($9k per month).

Unlike prior scenarios that have focused on Medicare Part D drugs, this scenario considers a class comprised entirely of Part B drugs. This introduces several new dynamics to account for across key stakeholders:

- Formulary Management: Plans incur the majority of financial liability for the cost of medicines; however, formulary controls are not as widespread throughout the Part B benefit. Several Medicare Advantage plans (i.e., United Health Care, Aetna, Cigna, Humana) have demonstrated some willingness to implement step therapy in Part B for select drug classes, including oncology, VEGF-A inhibitors, colony stimulating factors (short & long acting), and erythropoietic agents.(10,11,12,13) Today there are very few formulary exclusions for provider-administered treatments in MA plans. This may change post-IRA, as MA plans may be more incentivized to manage these medicines aggressively.

- Patient Costs: Nearly 70% of beneficiaries enrolled in Medicare FFS have supplemental insurance, including Medigap, which significantly reduces patient cost sharing. (14) Accordingly, these patients are unlikely to observe a meaningful out-of-pocket cost difference between DNP and non-DNP brands. In contrast, while MA plans feature an out-of-pocket cap for the medical benefit, patients taking provider-administered medicines can face significant cost sharing for their medicines below the cap. As such, MA plans may be able to implement cost-sharing differentials that could drive utilization toward DNP brands.

- Prescriber Net Cost Recovery: The more discounts a manufacturer provides, the more a brand’s ASP declines, which challenges a provider’s reimbursement and lowers their net cost recovery (NCR). NCR is the difference between a provider’s purchase price and subsequent reimbursement, and providers have an incentive to maximize their NCR. For this reason, manufacturers are not able to provide high discretionary rebates without risking the ability of providers to achieve a positive NCR when reimbursement is based on ASP.

Provider Considerations:

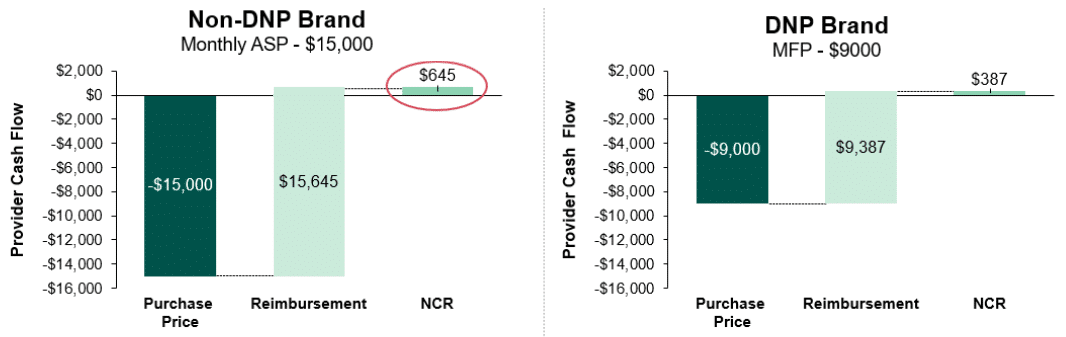

Provider NCR is an additional dynamic that introduces new incentives and added complexity in markets with provider-administered brands. Today, provider-administered brands in Medicare are reimbursed based on ASP, but the IRA stipulates that providers will be reimbursed for DNP drugs based on the negotiated MFP. As a result of this provision, providers will see less favorable NCR when prescribing DNP brands. In Figure 2 we illustrate the NCR for the DNP brands and the non-DNP brand for our illustrative class of interest. As shown, providers’ average purchase price for the non-DNP brand is higher than the DNP brands ($15k vs. $9k). However, Medicare reimbursement for the non-DNP brand is also higher at ASP plus 4.3% of ASP (or $15k plus $15k * 4.3%) as compared to MFP plus 4.3% of MFP (or $9k plus $9k * 4.3%) for the DNP brands.(15) These reimbursement dynamics result in an NCR of $645 per script for the non-DNP brand and an NCR of $387 per script for the DNP brands. This disparity in provider NCR between DNP and non-DNP brands incentivizes providers to favor the non-DNP brand (assuming no clinical reason for preferring the DNP drug exists). It is worth noting that CMS recognized this reimbursement incentive with biosimilars and altered reimbursement to ensure providers receive comparable NCR between biosimilars and reference brands, but the same dynamic was not accounted for with the IRA.

Figure 2: Medicare Part B Net Cost Recovery Calculation, DNP vs. Non-DNP Brands(16)

Plan & Manufacturer Considerations

As discussed in paper 2 and paper 3, the Medicare Part D redesign will result in additional liability for Part D plans, and it is expected that plans will seek opportunities for cost savings as a result. For provider-administered brands in Medicare Part B, FFS Medicare and Medicare Advantage plans will be more limited in their ability to implement formulary controls as a means of achieving cost savings. Post-IRA, FFS Medicare will remain limited to implementing prior authorizations and excluding drugs from coverage in rare instances as a mechanism to achieve cost savings. In contrast, Medicare Advantage plans will have a greater ability to implement utilization management as a cost containment mechanism. It is important to note that Medicare Advantage plans currently apply utilization management criteria sparingly as it can have a substantial impact on beneficiary satisfaction and Star Ratings (which directly impact the plan’s reimbursement). In the future, Medicare Advantage plans will need to weigh the potential benefit of implementing utilization management criteria against the potential impact to Star Ratings.

Although FFS Medicare and Medicare Advantage plans will be limited in their use of formulary controls, it is still expected that they will leverage the tools available to drive appropriate utilization. For MA plans, formulary decisions may be influenced by discretionary rebates from manufacturers. Despite increased pressure from plans, manufacturers of provider-administered drugs are unlikely to offer substantial discretionary rebates to differentiate access with competitors, regardless of negotiation status. Manufacturers of provider-administered DNP brands may consider offering discretionary rebates but will not be incentivized to do so as they will already offer a cost advantage to payers, and any discretionary rebates they do offer will impact ASP and thus negatively impact provider reimbursement.(17) Similarly, non-DNP manufacturers are unlikely to offer significant discretionary rebates as it will reduce the higher NCR providers will realize as compared to DNP products. Additionally, as with DNP brands, any discretionary rebates offered by non-DNP brands will negatively impact provider reimbursement.

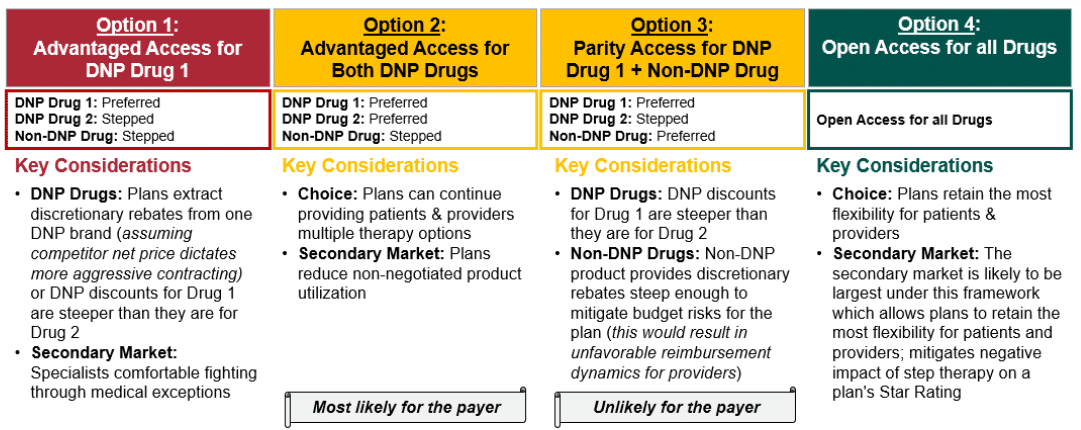

With these considerations in mind, Figure 3 outlines the potential ways in which competition could unfold post-IRA for scenario 3 in Medicare Advantage plans. HCG posits that given the limited ability for plan control, disincentives for discretionary rebates, provider NCR incentives, and likely provider ability to gain exceptions to utilization management criteria, Medicare Advantage plans are most likely to prefer the DNP brands (Option 2 in Figure 3). Plans will be limited in their ability exclude or heavily manage non-DNP provider-administered brands, especially if they do not satisfy all patient indications, making Option 1 (i.e., first line exclusive access for one DNP brand) unlikely. If Star Ratings will be impacted substantially by applying step therapy requirements to non-DNP drugs, Medicare Advantage plans may opt for open access for all drugs regardless of negotiation status (Option 4). HCG does not expect that non-DNP brands will be able to achieve preferred access over DNP brands (Option 3) since non-DNP drugs will not be able to provide the discretionary rebates required to compete with the DNP discount without negatively impacting ASP and thus provider reimbursement. Given that providers will be incentivized to prescribe the non-DNP brand as a result of NCR, Option 2 is expected to be preferred by Medicare Advantage plans.

Figure 3: Strategic Option Set for Medicare Advantage Plans

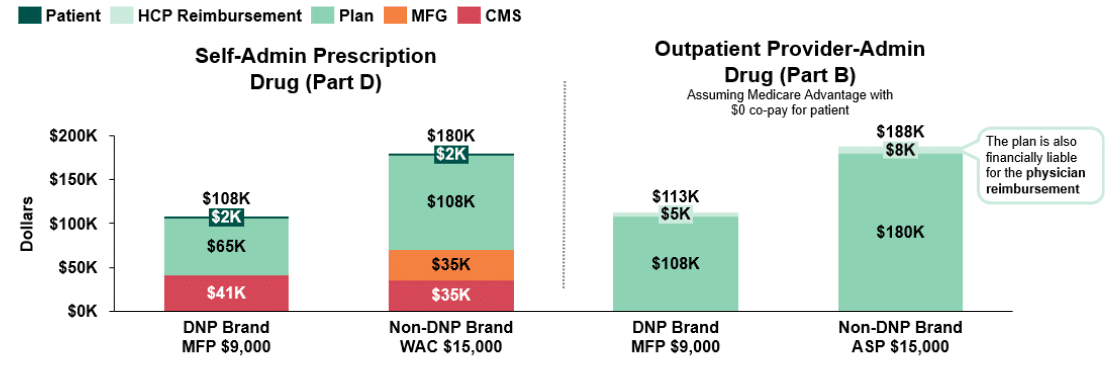

While we have considered an illustrative class of exclusively provider-administered products in this paper thus far, it is important to note that many provider-administered brands compete in classes with self-administered retail pharmacy benefit drugs covered under Medicare Part D. When we consider the impact the administration channel may have on incentives in these mixed classes, the scenario becomes increasingly complex. In Figure 4 we breakdown and compare stakeholder liability for a self-administered retail vs. outpatient provider-administered $9k DNP brand (Drug 1 & 2) and a $15k non-DNP brand (Drug 3) as a means of understanding the impact of being administered through the pharmacy benefit (Part D) as compared to the medical benefit (Part B). As observed in Figure 4, plans incur lower costs for DNP drugs, with less liability for DNP drugs administered through the pharmacy benefit ($65k vs. $108k). For non-DNP drugs, plan liability for self-administered retail drugs is even more favorable than the plan liability for outpatient provider-administered drugs ($108k vs. $188k) due to larger discretionary rebates that may reduce plan liability in Part D.

Figure 4: Post-IRA Stakeholder Liability Comparison for Self-Administered Prescription Drugs (Part D) vs. Outpatient Provider Administered Drugs (Part B)(18)

Future Dynamics & Conclusion

Throughout this series, HCG has focused primarily on the IRA’s drug negotiation program and the resulting competitive dynamics in retail prescription & outpatient drug classes. We have evaluated three illustrative classes of interest, breaking down changing stakeholder incentives to better illustrate how markets may change with the implementation of government negotiation.

Through this exercise we have unpacked key market dynamics that should be expected with the implementation of government negotiation through the IRA:

- The cost of access and the extent of utilization management will increase as plans face additional budgetary risk and liability following the Medicare Part D redesign.

- Exceptions to increased formulary exclusion and utilization management controls include Part D’s six protected classes (where products cannot be excluded from formulary) and within Part B FFS Medicare where there is little ability to effectively manage products (e.g., prefer one product over another).

- Across all scenarios reviewed, the magnitude of the MFP discount will be the greatest determinant of competitive dynamics in the market.

- If the MFP discount is high, non-DNP brands will be unable to compete directly against DNP brands and will be forced to compete within a secondary market.

- However, if discretionary rebates for non-DNP brands are able to effectively reduce plan liability to within range of liability for DNP brands, manufacturers of non-DNP brands may be able to compete head-to-head for access with a DNP brand.

- The extent to which clinical differentiation will allow for non-DNP brands to challenge a DNP brand’s advantage without the aid of discretionary rebates remains to be seen.

- Aside from government negotiation, there are a number of other policy changes in the IRA that will substantially impact a brand’s overall strategy and performance.

- The Medicare Part D redesign will reduce margins for many specialty products, adding pressure on manufacturers’ ability to leverage discretionary rebates to compete for formulary access.

- Inclusion of Low Income Subsidy (LIS) patients in the mandatory Part D discounts paid by manufacturers in the Initial Coverage and Catastrophic Coverage phases will have a substantial impact on product margin.

- Inflation rebates in Medicare Parts B and D will limit drug price increases, which will further apply pressure on brand margin and ability to negotiate voluntary discounts.

- Given the additional financial pressure all brands will face, it is expected that manufacturers will be required to re-evaluate investments for existing brands and pipeline assets.

- Existing brands will be forced to closely evaluate sales, potentially reducing future investment in marketing, patient savings programs, and contracting investments across channels. This may impact not only Medicare patients, but also those that are commercially insured.

- Additionally, it is likely that manufacturers will be required to considerably reassess their existing pipelines to better understand the investment and return on each therapy in development, resulting in a decline in approved drugs in in the future.

- Manufacturers will also need to reassess R&D efforts to focus development on fewer assets to ensure new launches will be sustainable.

In anticipation of expected changes following the IRA, it will be increasingly important for stakeholders to form a perspective on how they will be impacted in order to strategically plan. While full implementation of several key policies is years in the future, we are already beginning to see the market evolve with plans evaluating the evolution of their formulary management and manufacturers beginning to re-evaluate their current contracts. While it remains uncertain exactly how market dynamics and competition will evolve with the implementation of the IRA, we know with certainty that changes will happen, implementation will be very complex, and it will vary quite a bit from market to market as stakeholder incentives and economics shift in very different ways.

Sources

[1] Although the Inflation Reduction Act refers to the program as a negotiation, HCG assumes that manufacturers will effectively be required to accept the government’s terms, given the penalty for non-compliance is so severe.

[2] In 2022, 52% of beneficiaries were enrolled in FFS Medicare and 48% were enrolled in Medicare Advantage. KFF data kff.org: Total Medicare Advantage Enrollment (2022)

[3] As discussed later in this white paper, discretionary manufacturer rebates have downstream consequences for a drug’s Average Sales Price, which can result in lower provider reimbursement for the drug.

[4] Part B expenditures were measured at ASP while Part D expenditures were based on gross spend.

[5] Farxiga is expected to have a generic/biosimilar on the market prior to selection for the DNP, which will impact its DNP eligibility

[6] CMS data.cms.gov: Medicare Part B and D Spending by Drug (2020)

[7] For Drug 1 and Drug 2, 65% of non-FAMP is assumed to be less than the current Medicare net price.

[8] “A Comparison of Brand-Name Drug Prices Among Selected Federal Programs,” Congressional Budget Office (Feb 2021)

[9] Klein, M., D’Anna, S., Klasner, J., Pierce, K., (31 Aug 2022). The Inflation Reduction Act: What’s Changing in Healthcare?

[10] United Healthcare Medicare Advantage Medical Benefit Drug Policy “Medicare Part B Step Therapy Programs” (2022)

[11] Aetna Medicare Advantage (MA) “Part B Preferred Drug List” (2023)

[12] Cigna Medicare Advantage (MA) “Step Therapy Requirement for Part B Drugs and Biologics” (2021)

[13] Humana Medicare Advantage (MA) “Summary of Medicare Preauthorization and Notification List Changes” (2022)

[14] AHIP: “The State of Medicare Supplemental Coverage” (2021)

[15] A sequestration order in the Budget Control Act of 2011 reduced Medicare reimbursement from ASP + 6% to ASP + 4.3%; the pause in sequestration due to COVID that temporarily increased reimbursement has ended

[16] Assumes the provider reimbursement threshold is ASP+4.3%

[17] Including in the commercial market, where provider reimbursement is also commonly based on ASP.

[18] Assumes manufacturers provide no rebates; Assumes a patient starts therapy at the beginning of the calendar year, and remains adherent to therapy; Assumes the patient has no other drug spend; For Medicare Part D, assumes patient enters Initial Coverage Phase after patient OOP exceeds $480; For Medicare Part D, assumes patient enters Coverage Gap Phase after patient TROOP exceeds $1468; For Medicare Part D, assumes patient enters Catastrophic Coverage Phase after patient TROOP exceeds $7050; For Medicare Part D, DIR fees in Catastrophic Coverage Phase are not accounted for; For Medicare Part B, assumes provider reimbursement threshold in ASP+4.3%