Understanding PBM Compensation – Part II

This three-part series examines the business practices of pharmacy benefit managers (PBMs) and identifies potential policy solutions to address misaligned incentives in the pharmaceutical supply chain.

Untangle Complexity

10/29/2021

Read time: 7 min

Evolution of the PBM Landscape

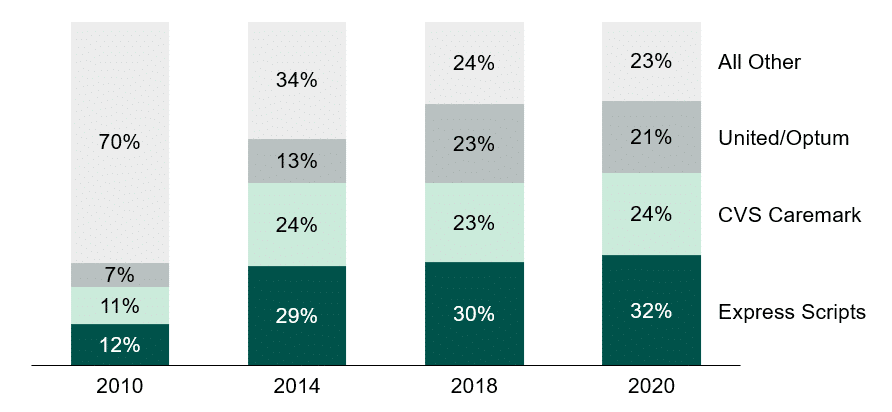

As noted in Part I, PBMs are organizations that provide negotiating leverage, benefit administration, and contracting expertise to their health plan and employer clients. PBMs’ market power grew in the late 1990s, largely because of rising expenditures on retail medicines and employers’ desire to control costs.(1) Over the past decade, the negotiating leverage of PBMs has increased significantly, driven primarily by horizontal consolidation within the market.

In 2009, hearings for the then-proposed Express Scripts purchase of WellPoint’s NextRx PBM business highlighted the industry’s diversity and disaggregation, noting that up to 90 PBMs were active in the market at that time. As witness Dana Felthouse, President of the Pharmacy Benefit Management Institute, noted, ‘Today there are so many different PBMs that have different strategies and emphasis in different areas that employers really do have a great deal of choice.”(2)

However, in the years that followed, rapid and drastic consolidation occurred within the PBM industry. While PBMI and PCMA note that there are 66 full-service PBMs in the country, by 2018, more than 75% of the prescription drug market was controlled by just 3 large PBMs.(2,3,4,5,6) With the market now concentrated among just a few large firms, the ability of PBMs to continue to generate additional market power through mergers and acquisitions has declined, leading to a leveling out of horizontal market consolidation in recent years.

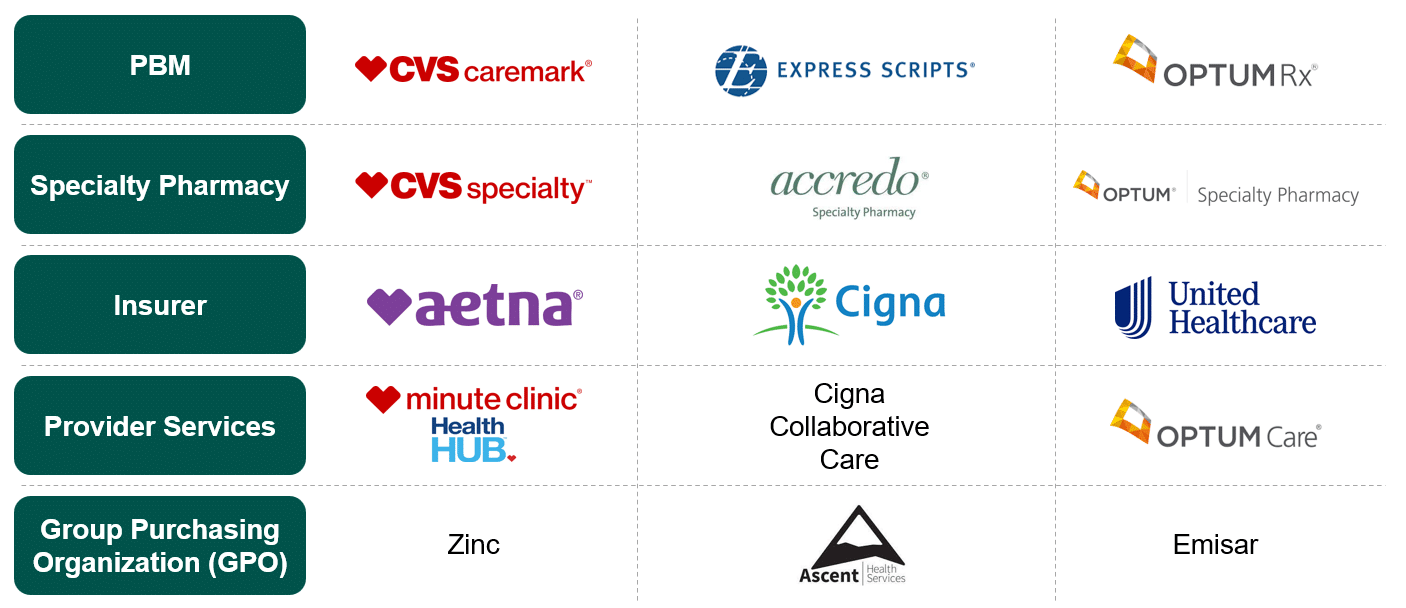

PBMs have turned to developing vertical business relationships, generating additional market power. While PBMs have historically included mail-order pharmacies, many have since expanded into specialty pharmacies. Today, the three largest specialty pharmacies are owned by the three largest PBMs: CVS Specialty with CVS Health, Accredo with Cigna (Express Scripts), and OptumRx with UnitedHealth Group.(7) Moreover, these PBMs are a part of continually expanding vertically integrated systems comprised of a diverse range of stakeholders, including health insurers, provider groups, and the latest acquisition target: group purchasing organizations (GPOs).(8) Starting in 2018, the same year the US Department of Health and Human Services first proposed rebate reform, all 3 major PBMs started processing their rebate contracts through a GPO construct.(9,10) While the PBMs continue to manage the formulary, pharmaceutical manufacturers can now be required to contract with these GPO entities rather than directly with the PBMs.

With the rise of vertically integrated systems, the once-independent nature of PBMs has diminished, leading to a shift in their relationships with employer clients. PBMs are no longer solely focused on negotiating rates for outpatient prescription drugs. Instead, they have entered into mergers and partnerships with insurers, pharmacies, and healthcare provider groups. This integration allows them to pool lives for maximum purchasing power and capitalize on various aspects of the pharmaceutical supply chain. PBMs now benefit from both prescribing medications through frontline physicians and sourcing and dispensing these drugs through their self-owned and affiliated pharmacies.(11) Interestingly, a survey cited by Citibank Investment Research in 2009 revealed that 71% of 170 self-insured employers preferred using PBMs that were not owned by health plans.(13) These employers believed that independent PBMs, focused solely on meeting their drug benefit needs, would offer better value and services.

Vertical Business Incentives for PBMs

In Part I of our series, we focused on understanding PBM revenue derived through contracts with manufacturers and health plans or employer plan sponsors. One of the key reasons PBMs are a part of vertically integrated systems is to develop additional revenue streams.(14) With the formation of vertically integrated systems and the market control that they create, PBMs may now receive additional revenue from the following fee structures and relationships across the drug value chain:

- Pharmacy Dispensing: PBM-affiliated retail, mail-order, and specialty pharmacies provide dispensing fees, spread pricing, value-added services revenues, and volume-purchasing discounts that all flow to the corporate entity.

- Pharmacy Networks: Non-affiliated retail and specialty pharmacies provide discounted rates to be included in PBMs’ preferred networks, which reduces costs for the PBM.

- GPO Structure: By requiring manufacturers to contract with GPO entities (versus with the PBM directly), another layer has been added to the contracting process, and less transparency and more layers of fees are the most likely initial outcome. Moreover, Express Scripts and OptumRx have also established their GPOs outside of the US, further limiting transparency and preventing other stakeholders from auditing the value added.(11,12)

Policy Considerations

The consolidation of PBMs has led to even greater market power, with increased leverage when negotiating contracts with pharmaceutical manufacturers and other stakeholders. Yet, as PBMs are able to extract higher rebates, it is unclear how, if at all, this value is passed through to the employers or patients. In addition to horizontal expansion, vertical integration across various stakeholders in the health care system has bred an environment that lacks transparency. It underscores the way PBMs can structurally morph to potentially avoid or side-step regulations. In particular, the diversification of PBM revenue streams may create conflicting interests, including lack of contracting efficiency, the stacking of additional fees across intermediary stakeholders, and even flowing revenue through offshore entities to limit visibility.

To better align PBMs’ incentives and objectives with the interests of their commercial health plan and employer clients, state and federal policymakers should:

- Explicitly establish fiduciary duty for PBMs – Where there are conflicts between PBMs’ financial interests and the interests of their clients, PBMs currently operate with a lack of accountability, particularly at the federal level. Explicitly characterizing PBMs as plan fiduciaries could better align incentives, as PBMs would be required to put their clients’ interests ahead of their own.

- Increase PBM transparency and reporting requirements – Requiring PBMs to report plan-specific data on their rebate revenue, administrative fee revenue, spread pricing revenues, and other services revenue to employers and health plans would enable visibility into revenue streams and the portion of revenues generated that are retained versus passed through to clients. Additionally, these reports would allow for the true costs of hiring a PBM to be readily understood by health plans and employers.

- Limit affiliate “steering” – Today, many PBMs require commercial patients to fill their prescriptions with affiliate pharmacies (i.e., those that own the PBM or are owned by the PBM). Medicare, many state Medicaid programs, and state insurance regulators already require Part D plan sponsors, Medicaid managed care organizations, and/or commercial health plans, respectively, to accept ‘any willing provider’ pharmacies. Prohibiting PBMs from directing patients to affiliate pharmacies would increase competition and reduce incentives for PBMs to self-deal with owned or affiliated outlets.

In Part III, we will discuss how PBM compensation models and PBM consolidation impact patient cost sharing and access.

Sources

(1) Burns, L. R. (2021). Contracting for Prescription Drug Benefits: Role of Employers, Insurers, and Pharmacy Benefit Managers. In The U.S. healthcare Ecosystem: Payers, PROVIDERS, PRODUCERS (p. 297). essay, McGraw Hill.

(2) Wojcik, Joanne, “Express Scripts buys PBM from WellPoint”, Business Insurance, April 19, 2009, https://www.businessinsurance.com/article/20090419/STORY/100027492

(3) Monson, Derek. PBMs and Your Prescription Drug Bill, December 01, 2020. https://sutherlandinstitute.org/pbms-and-your-prescription-drug-bill/

(4) Top 50 PBM Companies and Market Share; AIS Quarterly Survey of PBMs, SPPs and Related Companies for Drug Benefit News, 2010

(5) Fein, Adam J., PBM Market Share by Total Equivalent Prescriptions Managed, 2014, Drug Channels Institute, 2015. https://www.drugchannels.net/2015/03/optumrx-sails-away-with-catamaran-deal.html

(6) Fein, Adam J., PBM Market Share by Total Equivalent Prescriptions Managed, 2018, Drug Channels Institute, 2019. https://www.drugchannels.net/2019/05/cvs-express-scripts-and-evolution-of.html

(7) Fein, Adam J., PBM Market Share by Total Equivalent Prescriptions Managed, 2020, Drug Channels Institute, 2021. https://www.drugchannels.net/2021/04/the-top-pharmacy-benefit-managers-pbms.html

(8) Fein, Adam J. DCI’s Top 15 Specialty Pharmacies of 2020: PBMs Expand Amid the Shakeout – while Walgreens’ Outlook Dims, 2021. https://www.drugchannels.net/2021/09/dcis-top-15-specialty-pharmacies-of.html#more)

(9) Fein, Adam J., Vertical Business Relationships Among Insurers, PBMs, Specialty Pharmacies, and Providers, Drug Channels Institute, 2021. https://www.drugchannels.net/2021/03/drug-channels-news-roundup-march-2021.html

(10) HHS American Patients First. 2018 May [cited 2018 May17]. (https://www.hhs.gov/sites/default/files/AmericanPatientsFirst.pdf

(11) Barlas, Stephen. Vertical Integration Heats Up in Drug Industry, 2018. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5737250/

(12) Fein, Adam J. Drug Channels New Roundup, May 2019: Express Scripts’ New GPO, More on Amazon/PillPack, a BS Update, and Vegas Video. May 2019. https://www.drugchannels.net/2019/05/drug-channels-news-roundup-may-2019.html

(13) Fein, Adam J. Drug Channels News Roundup, August 2021: OptumRx’s New GPO, Pharmacy DIR Fees, State Biosimilar Laws, UM Views, and a Newspaper Delivers. August 25, 2021. https://www.drugchannels.net/2021/08/drug-channels-news-roundup-august-2021.html