The Inflation Reduction Act – Part I

Part I in a series covering the Medicare drug pricing reforms enacted by the Inflation Reduction Act, focused on price negotiation and its anticipated impact on the biopharma landscape

Untangle Complexity

10/03/2022

Read time: 8 min

Background & Context

On August 16th, 2022, President Biden signed the Inflation Reduction Act (IRA) into law. While this significant piece of legislation contains many components, a primary goal of the legislation is to lower prescription drug costs and patient out-of-pocket costs through Medicare drug pricing reform.(2) The IRA seeks to achieve this goal through three main provisions:

- Redesign of Medicare Part D Standard Benefit

- Implementation of Inflationary Rebate Penalties

- Initiation of a Drug Negotiation Program (DNP) – this will be the focus of today’s paper

Drug Negotiation Program (DNP)

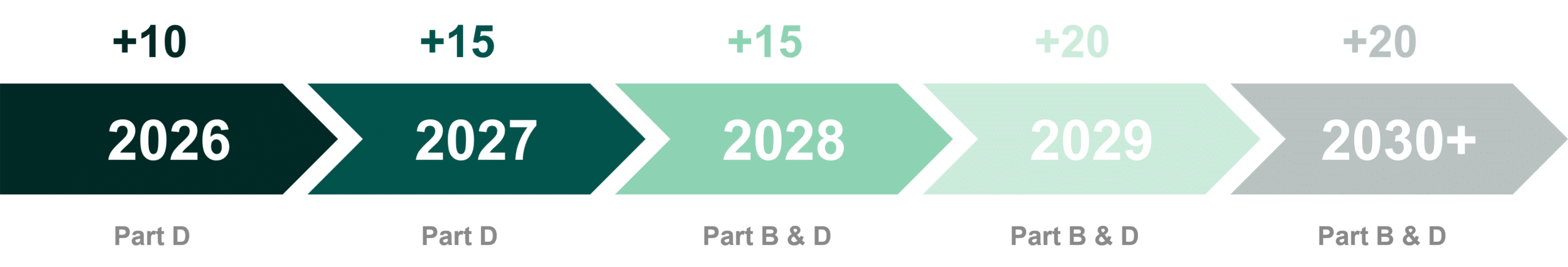

The Medicare DNP allows the Secretary of Health and Human Services (HHS) to select and negotiate a price for a number of branded drugs each year (defined by various criteria outlined below).(1,2) The number of negotiated drugs is incremental, with new drugs selected by HHS each year (and new drugs becoming negotiation-eligible each year).

Once a drug is selected, the HHS Secretary determines the ceiling price for negotiation based on parameters outlined in the law. The ceiling price represents the upper-bound for HHS and a manufacturer during the negotiation process; notably, the initial offer from HHS could be at or below this price. The negotiated price aims to achieve the lowest fair price for a drug, informed by factors such as R&D cost, recouped cost, and prior federal financial support.(2) The manufacturer has one opportunity to provide a counter negotiation, after which the Secretary determines the final price of the drug, referred to as the maximum fair price (MFP). Once a drug is negotiated, it remains negotiated until a generic or biosimilar enters the market. Additionally, a negotiated drug may be subject to re-negotiation at any time if it is determined the negotiation would result in a substantial impact to the negotiated price.(3) All negotiated medicines will additionally go through the re-negotiation process as they age into different categories based on the number of years since FDA approval.

All DNP negotiated drugs must be covered on insurers’ formularies and further discounts with the insurers can be offered by manufacturers for better formulary standing. The selection process for direct negotiation of Part D drugs will begin in 2023, and the MFPs for the initial set of 10 negotiated Part D branded drugs will be implemented in 2026.(3)

Compared to previous drug pricing proposals such as H.R.3, the number of drugs subject to government negotiation under the Inflation Reduction Act is smaller, with several limitations on which drugs can be negotiated, including:

- Must be a single source drug(2)

- At least 9 years have elapsed since FDA approval for small molecules, or 13 years since FDA licensure for biologics(2)

- Exempt if an orphan drug with a single indication for a rare disease or condition(2)

- Exempt if plasma-derived(2)

- Exempt if <$200M of total Medicare expenditures(2)

- Through 2028, exempt if the drug accounts for ≤1% of total Medicare expenditures in Part B or Part D, respectively, and makes up ≥80% of manufacturer’s revenues in Medicare(2)

Under a special process, a biosimilar manufacturer may request a pause in the selection of its reference biologic. In granting the pause, the Secretary must determine that the biosimilar has a high likelihood of being FDA approved and marketed within 2 years. Should the biosimilar fail to launch, the reference biologic will be subject to negotiation with a rebate owed to the government to cover the pause period.

Key Unknowns & Implications

There are several components of the DNP that remain unclear but will have a significant impact on the marketplace:

- Negotiation: It is unclear how the government will arrive at the negotiated price with the manufacturer, including the extent to which manufacturers will have leverage to negotiate, the weight the government will give to each of the factors informing the negotiated price, or whether the negotiated price will be near the “ceiling” or significantly lower

- Operation: How the DNP will be operationalized, and the impact on today’s drug distribution model, is not understood. For instance, the negotiated price needs to be offered to the patient at the point-of-sale; however, logistics for doing so are not defined.

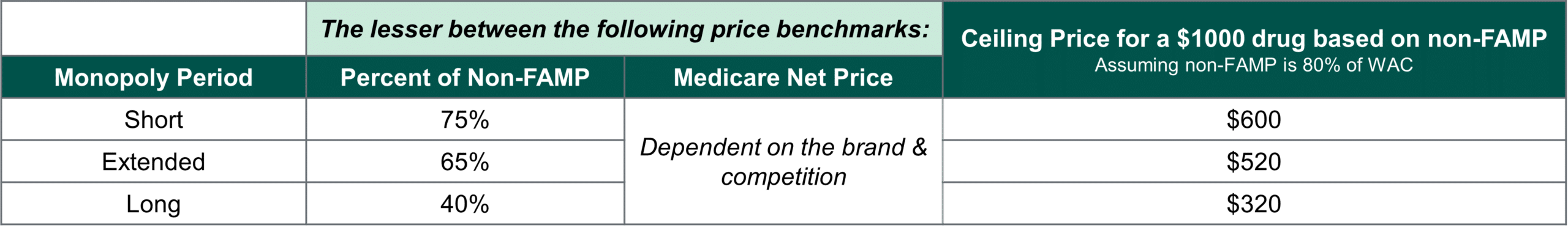

The ceiling price that HHS could offer a manufacturer for a selected drug depends on the length of time since FDA approval or licensure (see below). By indexing the ceiling price in this way, Congress has truncated the runway for many brands to recoup their investment. Today, brands typically observe 12-16 years on the market after FDA approval without generic competition, averaging 14 years.(3) Following implementation of the IRA, some brands will observe a significant decline in margin five years earlier in their lifecycle.

With no defined floor for the negotiated price, a manufacturer’s ability to negotiate will be effectively confined between the ceiling price and the cost of production. The ceiling price is the lesser of a discount off a drug’s non-federal average manufacturer price (non-FAMP) and its current Medicare Net Price. On average, Milliman estimates non-FAMP at 80-85% of a drug’s Wholesale Acquisition Cost (WAC) and a 2021 Congressional Budget Office (CBO) analysis corroborates that among top-selling drugs in the Part D program, non-FAMP averages 80-87% of WAC.(4,5)

Moreover, it is unknown how the negotiation process will be conducted. It is uncertain what logic or considerations will be meaningfully evaluated by HHS. It is likely that the most impactful counterevidence will be clinical differentiation, which may impact the extent & amount of R&D a brand must invest in to prove its clinical value proposition. Ultimately, HCG assumes that it is unlikely that an agreement will not be reached, as the penalty for not participating in the DNP is worse than any MFP the brand would need to accept.

Finally, there are many outstanding questions related to how the DNP will be operationalized. The IRA legislation states that patient cost-sharing will be tied to the MFP at the pharmacy, but whether this is handled as an upfront purchase by the pharmacy at the MFP price or as a post-sale reconciliation between the manufacturer and pharmacy is unclean.

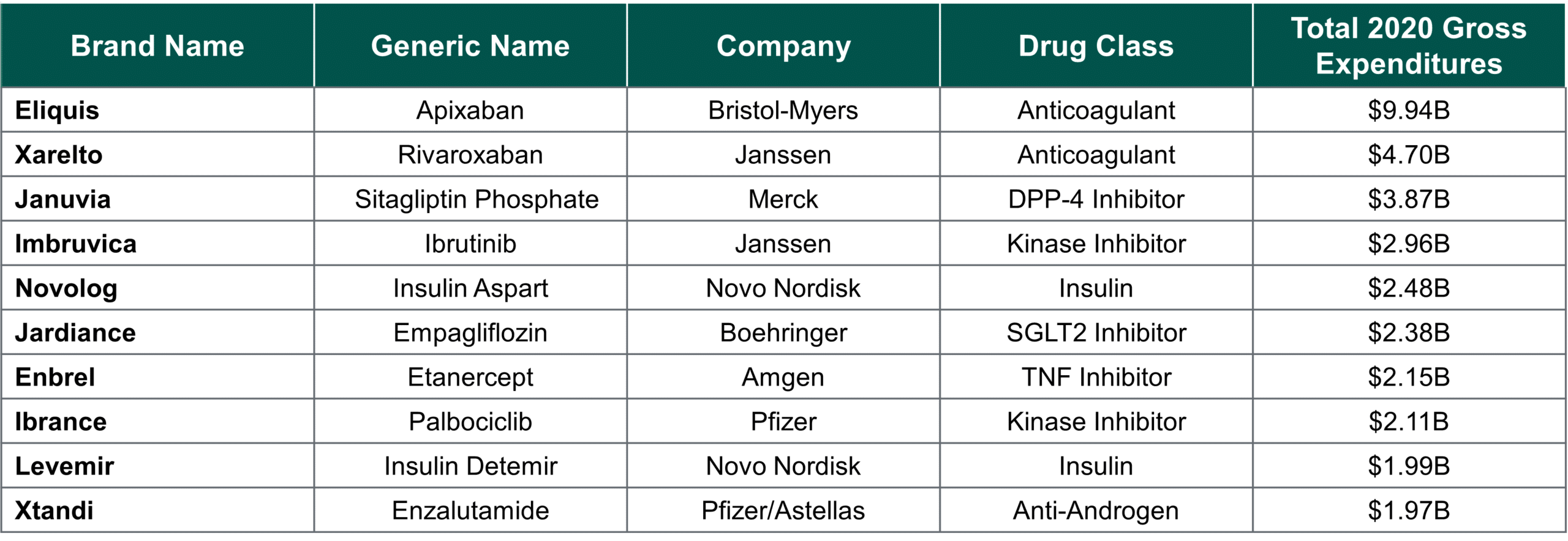

Biopharma Manufacturers Expected to be Affected First

Notably, the legislation has not explicitly defined if products will be selected based on total gross or total net expenditure in Medicare Part D.(6) This distinction has significant implications for which part of the biopharma landscape will be first exposed to price negotiation in 2026. If selection is based on total gross expenditure, the therapeutic areas expected to be most impacted are the cardiovascular and diabetic landscapes. Two of the three branded anticoagulants could be subject to the DNP – Eliquis (Bristol-Myers) and Xarelto (Janssen), as well as two insulins, Novolog (Novo Nordisk) and Levemir (Novo Nordisk), and two oral anti-diabetics, Januvia (Merck) and Jardiance (Boehringer).

Top 10 Expected DNP-Eligible Medicare Part D Drugs, Ranked by 2020 Gross Expenditures(7,8)

There is a significant overlap in the top Part D drugs by total gross versus total estimated net spend; however, the order in which the top drugs are ranked is different, which will ultimately be the deciding factor for when an individual drug will be selected for negotiation. If selection is based on estimated total net expenditure, more diabetic therapeutic areas would likely be impacted sooner, such as the GLP-1s, and more protected classes could be impacted, like the antipsychotics. Moreover, classes with highly rebated or discounted markets move further down the list, such as diabetes sub-classes, including insulins and SGLT2 inhibitors. Although insulins have historically been a focus of price control, they may not be controlled within the first year of the DNP depending on whether CMS adopts a gross or net price ranking, as they are already highly discounted.

Conclusion & Next Steps

Many unknowns still exist about the IRA’s implementation, including how the drug negotiation process will work and how our current health system must operationally adapt to incorporate the legislation’s requirements. But it is clear that the DNP will have a major impact on the brands that are subject to price controls, and the markets that they compete in. In our next whitepaper, we will unpack the competitive dynamics for markets with one or multiple price-negotiated products – focused on the CDK4s and anti-coagulants (which are likely to be impacted, irrespective of net or gross expenditure eligibility). We will review the impact to key stakeholders, along with what biopharma can do to mitigate risk & prepare for these significant changes.

Sources

[1] Deutsch, H., Powers C., Yuen, R., (15 Aug 2022). The Inflation Reduction Act: What biopharma manufacturers need to know.

[2] HCG assumes that all brands will effectively be required to participate in the negotiation process, given the penalty for non-compliance is so severe.

[3] Hunt, M., Frois, C., Albarano, R., Mock, G., (Aug 2022). Inflation Reduction Act of 2022: No room for Negotiation.

[4] Klein, M., D’Anna, S., Klasner, J., Pierce, K., (31 Aug 2022). The Inflation Reduction Act: What’s Changing in Healthcare?

[5] “A Comparison of Brand-Name Drug Prices Among Selected Federal Programs,” Congressional Budget Office (Feb 2021)

[6] Section 1860D-15(b)(3)5: “The term ‘gross covered prescription drug costs’ means, with respect to a part D eligible individual enrolled in a prescription drug plan or MA-PD plan during a coverage year, the costs incurred under the plan, not including administrative costs, but including costs directly related to the dispensing of covered part D drugs during the year and costs relating to the deductible.

[7] CMS data.cms.gov: Medicare Part D Spending by Drug (2020)

[8] Drugs expected to have a generic/biosimilar on the market prior to selection in 2023, and those that won’t have been on the market long enough by implementation in 2026 have been excluded from this list.