Understanding PBM Compensation – Part I

This three-part series examines the business practices of pharmacy benefit managers (PBMs) and identifies potential policy solutions to address misaligned incentives in the pharmaceutical supply chain.

Untangle Complexity

10/26/2021

Read time: 5 min

Although PBM compensation models have shifted in recent years, revenues have typically remained tied to list prices. Policymakers should consider laws and regulations to better address the misaligned incentives, such as delinking PBM compensation and contractual incentives from the price of medicines.

PBM Compensation Models

PBMs have developed two primary approaches to contracting that drive revenue, which are generally applicable across the commercial market: (1) spread pricing and (2) pass-through pricing.(1). In spread pricing models, PBMs receive a share of negotiated rebates and fees, typically 15%, and/or retain the difference between their acquisition and reimbursement amounts.(2,3) PBMs that use pass-through pricing contracts receive fee-based compensation directly from the health plan or plan sponsor, with negotiated rebates and other revenue streams directly passed through to their client.(1) Both compensation models can tie PBM revenue to the list price of medicines, and PBMs may utilize elements of both to different degrees within a given contract.

Retained Price Protection is one type of revenue source often incorporated into contracts between PBMs and manufacturers and is directly tied to the list price of medicines. Price protection clauses place a threshold on manufacturer price increases and result in a portion or all of a manufacturers price increase being rebated back to the PBM.(1,4)

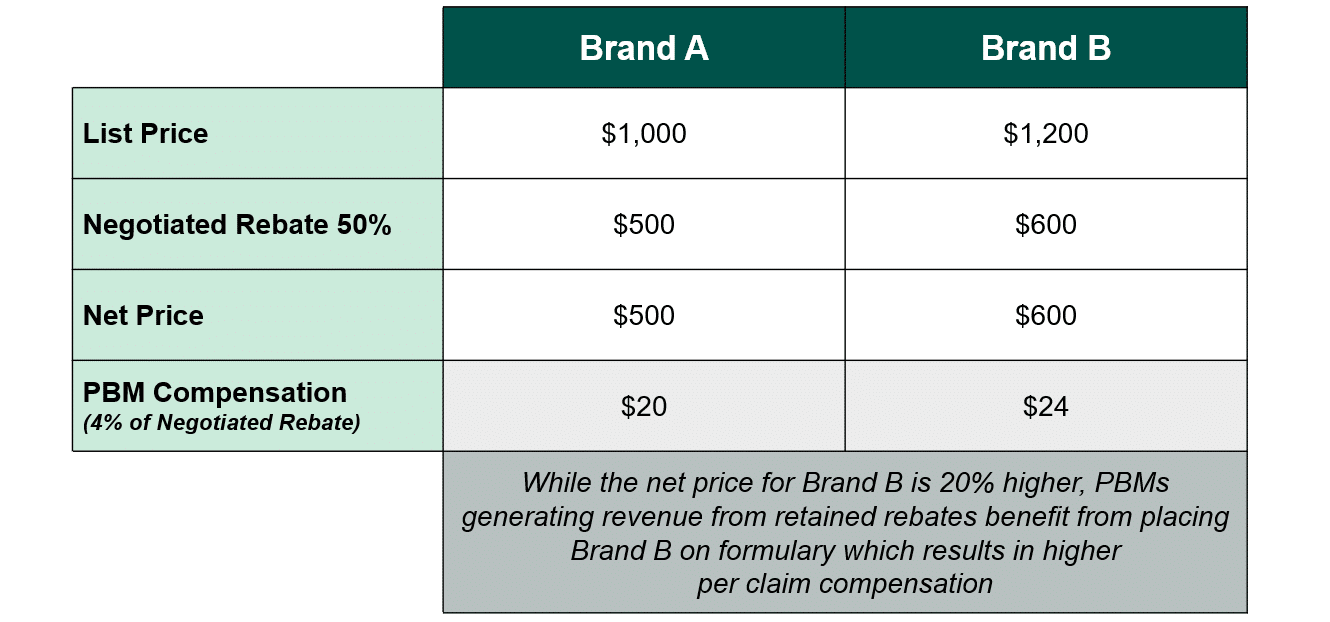

Economists, actuaries, and industry experts have noted that the direct link between revenue and the list price of a medicine creates incentives for PBMs to prefer higher list-priced medicines with large discounts over lower-cost alternatives.(5) Tying compensation to the price of medicines undermines PBMs’ stated goal of negotiating the lowest possible net price and instead incentivizes PBMs to seek the biggest differential between list and net price, regardless of the compensation model. Thus, the incentives driving negotiation may not result in the lowest net prices for plan sponsors or patients. Exhibit A illustrates how a higher-priced brand medicine can provide a greater discount and increased PBM revenue as compared to a lower-priced competitor.

Evolution of PBM Compensation Models in Response to Scrutiny

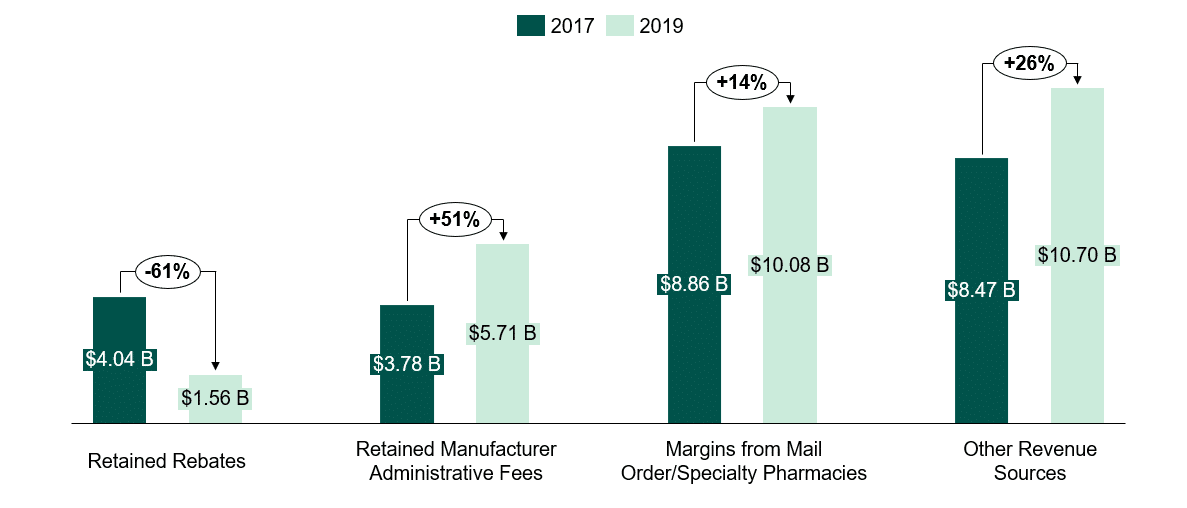

Over the last 3-5 years, PBM compensation models have drastically evolved, potentially in response to increased scrutiny of rebates from federal and state legislators, employers, and the public; changes in state laws; and anticipation of future policy reforms. PBMs are increasingly attempting to diversify their revenue streams by shifting to fee-based models.(6)

Despite making changes to their compensation models, PBMs do not typically “de-link” their revenue streams from the price of medicines.(7) Yet, the relationship between list price and compensation can perpetuate PBMs favoring medicines with high list prices and large rebates. Lack of insight into PBM compensation has allowed PBMs to operate in ways that evade certain laws and regulations and create revenue sources that may not be aligned with patient interests.

Potential Policy Solutions

Policy solutions to address PBM incentives should include delinking all forms of PBM compensation and PBM contractual incentives from the price of medicines. In recent years, policymakers at both the federal and state level have proposed reforming the rebate system by requiring PBMs and/or plans to pass through rebate savings directly to patients at the pharmacy counter or prohibiting spread pricing. Such state actions have usually followed audits or analyses that estimate the elimination of spread pricing contracts in those programs would result in significant savings to the state and taxpayers.(8,9,10,11,12) These policies would lower out-of-pocket costs for millions of patients and help address PBM misaligned incentives. However, the ongoing shift in PBM compensation models in which PBMs have already begun to move away from retained rebates to diversify and preserve their revenues could undermine the intended benefits of rebate reform. At least one state has proposed to limit payments from health insurers to PBMs to actual ingredient costs, dispensing fees paid to pharmacies, and a capped administrative fee.(13)

In Parts II & III, we will discuss the structure and consolidation of PBMs and the impact of the PBM model on patient cost sharing and access.

Sources

- Fein, Adam J., The 2020 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers, Drug Channels Institute, 2020.

- Foley, Paul. “The Return on Investment (ROI) on PBM Services,” n.d., 13.

- Dieguez, Gabriela, Maggie Alston, and Samantha Tomicki. “A Primer on Prescription Drug Rebates: Insights into Why Rebates Are a Target for Reducing Prices,” 2018, 5.

- Burns, L. R. (2021). Contracting for Prescription Drug Benefits: Role of Employers, Insurers, and Pharmacy Benefit Managers. In The U.S. healthcare Ecosystem: Payers, PROVIDERS, PRODUCERS (p. 297). essay, McGraw Hill.

- Shepherd, Joanna. “Pharmacy Benefit Managers, Rebates, and Drug Prices: Conflicts of Interest in the Market for Prescription Drugs.” SSRN Electronic Journal, 2019. https://doi.org/10.2139/ssrn.3313828.

- Understanding the Evolving Business Models and Revenues of Pharmacy Benefit Managers, PBM Accountability Project, 2021.

- “Pharmacy Benefit Managers Practices Controversies What Lies Ahead | Commonwealth Fund.” Accessed August 5, 2021. https://www.commonwealthfund.org/publications/issue-briefs/2019/mar/pharmacy-benefit-managers-practices-controversies-what-lies-ahead.

- “Final Investigative Report: Pharmacy Benefit Managers in New York.” May 31, 2019. https://www.nysenate.gov/sites/default/files/article/attachment/final_investigatory_report_pharmacy_benefit_managers_in_new_york.pdf.

- “Ohio’s Medicaid Managed Care Pharmacy Services Auditor of State Report.” August 16, 2018. https://audits.ohioauditor.gov/Reports/AuditReports/2018/Medicaid_Pharmacy_Services_2018_Franklin.pdf.

- “Medicaid Pharmacy Pricing Opening the Black Box.” February 19, 2019. https://chfs.ky.gov/agencies/ohda/Documents1/CHFSMedicaidPharmacyPricing.pdf.

- “Lembo Announces First-of-it’s-Kind Pharmacy Contract that Establishes New Era of Drug Pricing and Transparency.” June 19, 2019. https://www.osc.ct.gov/public/pressrl/2019/NewEraofDrugPricingTransparencyandAccountability.pdf.

- “Audit and Monitoring Report: Contract Compliance CVS/Caremark Pursuant to Public Act 408 of the 108th General Assembly.” Department of Finance and Administration Division of Benefits Administration, State of Tennessee. May 2019.

- “An Act to amend the insurance law, in relation to reducing pharmacy benefit manager costs.” New York State Senate Bill S1768. https://www.nysenate.gov/legislation/bills/2021/s1768.